-

World Gold Council embraces blockchain: gold tokenization pilot prepares for digital future

Thu Oct 03 2024

While gold has recently reasserted its dominance as the top safe-haven asset in times of economic and geopolitical strife, there’s no denying that the yellow metal needs to be ready for a digital future. However, the World Gold Council (WGC) recently showed that it's never too late to teach an old dog new tricks.

Digital Asset, a leading provider of blockchain solutions, has announced the successful completion of a collaborative initiative that tokenized gilts, Eurobonds, and gold, which included participation by the WGC. Other participants included Euroclear, the global law firm Clifford Chance, and various other parties, such as investors, banks, CCPs, custodians, and a central securities depository.

The purpose of the pilot was to demonstrate how tokenized assets on a blockchain can enhance collateral mobility, improve liquidity, and increase transactional efficiency, Digital Asset said in a press release.

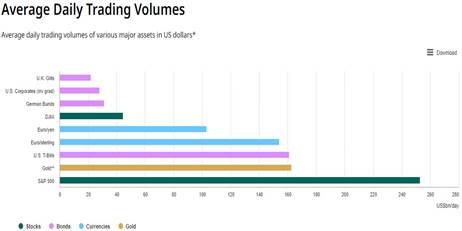

In 2023, the average daily trading volume for gold hit $162 million worldwide, and with the figure for 2024 shaping up to be similar, it's clear that the growth and use of gold as a traded asset show no signs of slowing.

Meanwhile, “Sovereign Gilts and Eurobonds offer a deep pool of high-quality liquid assets,” Digital Asset said. “As of mid-2023, the total market of Gilts in the UK amounted to nearly GBP 2.4 trillion, with over EUR 12.97 trillion of outstanding Eurobond issuance.”

In the pilot, which took place in June and July, 27 market participants used the Canton Network – the financial industry's “first and only public chain that can achieve on-chain privacy, control, and interoperability” – to connect five types of cross-application transactions using 11 distributed applications, including six registry apps and five margin apps, with a total of 500 transactions completed.

The trial successfully demonstrated the “ability to create a digital twin of these previously immobile real-world assets (RWAs) and use those tokenized assets as collateral in atomic, real-time transactions,” Digital Asset said.

“By digitizing gold, we can overcome the perceived restrictions on moving and storing the physical metal, enabling this high-quality asset to be mobilized and used seamlessly within financial markets,” said Mike Oswin, Global Head of Market Structure and Innovation at the World Gold Council. “To achieve this, the tokenization process must be able to specify a Standard Gold Unit (SGU) that represents and transfers the monetary value of an agreed amount of pure gold.”

“An attributes record can be created as a secondary token that will maintain details of the gold bars collateralized in the ecosystem,” Oswin added. “This would enable all physical gold of trusted integrity to be utilized as financial collateral, irrespective of its physical attributes and location.”

According to Kelly Mathieson, Chief Business Development Officer at Digital Asset, the pilot represents a notable “step forward in the development and adoption of tokenized assets in collateral management, creating a more mobile operating model across different parties.

“Our work with the pilot participants has demonstrated that tokenized assets can be used with immediate effect to meet intraday margin calls outside of normal settlement cycles, processing times, and time zones,” Mathieson added. “It also demonstrated how the ledger can serve as the legal record and has validated the secured party's control over the digital twin and real-world assets received as margin or collateral in the event of a counterparty default.”

Tokenization through creating a digital twin is rapidly becoming the go-to way to bring real-world assets on-chain and is expected to be the go-to method for RWA tokenization moving forward.

Paul Landless, Co-Head of Fintech at Clifford Chance, who observed the pilot, offered this opinion on the legal implications of utilizing a digital twin of a real-world asset.

“With certain approaches and platforms, a digital twin is not a separate asset and so the impact for master agreements, trading relationships, close-out processes, and valuation approaches are minimised, but it is always important to ensure the digital twin is catered for and reflected into existing product and platform documentation,” he said. “As an operational and record-keeping tool rather than an asset, some of the legal and regulatory issues can be reduced while avoiding extensive surgery or a wholesale reset of established product and asset documentation.”

This pilot program follows several earlier Canton Network pilots that established the foundation for composable applications across a global economic network.

In September, Digital Asset announced the completion of a pilot program conducted in conjunction with the Depository Trust & Clearing Corporation (DTCC), which trialed the U.S. Treasury (UST) Collateral Network, an initiative focused on leveraging distributed ledger technology (DLT) applications to support market connectivity across the collateral management lifecycle to enhance mobility, liquidity and transactional efficiency of tokenized assets.”

In that pilot, Digital Asset, four investors, four banks, two central counterparties, three custodians/collateral agents, and a central securities depository “operated fourteen Canton nodes, connecting four types of cross-application transactions through ten distributed applications, leveraging DTCC’s LedgerScan solution to support dynamic tracking and governance of the assets involved in the pilot transactions,” a press release said. “Participants successfully executed 100 transactions, demonstrating tokenized collateral assets' robust functionality and potential.”

The UST Collateral Network pilot “proved the feasibility of more complex real-world transactions, including the creation of a digital twin of USTs, utilizing the tokenized UST assets in real-time to satisfy margin calls, completing asset recalls, and evidencing secured party control over the assets in closeout scenarios,” Digital Asset said.

“Most blockchain pilots focus on initiating or completing transactions, but in this pilot, that lifecycle was extended to include default,” said Jenny Cieplak, a partner at global law firm Latham & Watkins. “This is crucial because collateral isn't just about mitigating risk – it ensures that in the event of a default, secured parties can take legal possession of the collateral. This demonstrates blockchain’s potential to support the full lifecycle of financial transactions, beyond just execution.”

According to Mathieson, the pilot proved “that tokenized assets could be leveraged to optimize collateral. In addition to the liquidity and operational efficiencies gained, the pilot demonstrates how tokenized collateral can improve market transparency, legal certainty of ownership in seizure/close out scenarios, and significant real-world benefits, including faster collateralization and enhanced regulatory oversight.”

Source: https://www.kitco.com/