-

Gold outperforms stocks, bank deposits in 2024

Thu April 18 2024

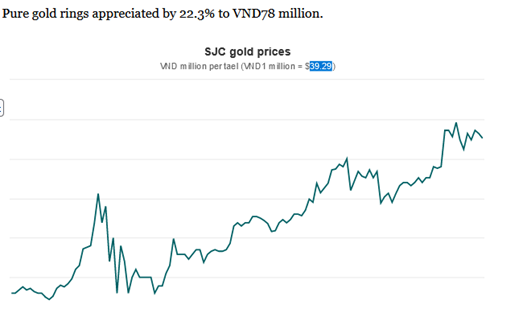

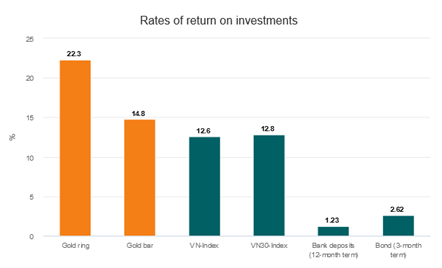

Gold prices have risen 15-22% this year, making it the best performing asset class. Bullion prices were up 14.8% to a historic high of VND85 million (US$3,373.7) per tael of 37.5 grams last week. Pure gold rings appreciated by 22.3% to VND78 million.

In comparison, bank deposits yielded 1.23% -- for a 12-month term -- and the benchmark VN-Index gained 13%. The precious metal’s rise was due to higher demand for safe-haven assets amid declining bank interest rates and intensifying geopolitical tensions. After rising sharply in late 2022, deposit interest rates have been falling steadily since mid-2023. While some banks raised their rates slightly last month due to a slowdown in deposit inflows, most lenders still maintained low rates of 5% for 12-month terms and 6% for 24-month terms. Bankers and analysts expect the low rates to persist until mid-year, after which there might be a slight rise as credit demand picks up.

However, they are unlikely to return any time soon to the high levels seen in 2022.

Stocks have also benefited from the lower interest rates as investors shifted their money from banks.

The number of trading accounts has increased by around 402,000, or 5.5%, so far this year. The average daily trading was worth VND22.53 trillion in the first quarter, up 28.2% from 2023.

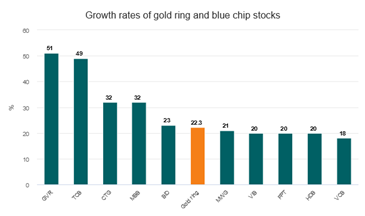

Nonetheless, the market has become volatile recently due to strong selling by foreign investors and fluctuations in the global market. Its 13% year-to-date growth has mostly been driven by banking stocks, the largest on the exchange.

But even in this group, some shares have witnessed a 5% decline in value. Meanwhile, most other sectors have lost 5-10%. Gold rings outperformed 25 of the 30 largest stocks on the Ho Chi Minh City Stock Exchange, Vietnam’s main bourse.

Some other asset classes, like real estate and bonds, have not seen much growth in recent years, according to experts. The bond market has been inactive since late 2022 after being rocked by the Van Thinh Phat scandal, which wrecked investors’ confidence and caused regulators to crack down hard on dubious practices.

At the time, Truong My Lan, chairwoman of property developer Van Thinh Phat, and others were arrested for alleged fraud related to the issuance of bonds worth trillions of dong (VND1 trillion = $39.58 million). The real estate market has only seen significant gains in certain segments and property is not as popular as other asset classes as it requires large initial investments.

"The low bank deposit interest rates are prompting people to invest elsewhere," Nguyen The Minh, head of retail research at securities brokerage Yuanta Vietnam, said. "Real estate and bonds have not yet hit their bottoms, so the rise in gold prices makes it an appealing investment."

Globally, gold prices have risen by 14.1% this year to $2,357.6 per ounce and still has some steam left, analysts said. Geopolitical instability, higher demand from central banks and expectations of a rate cut by the U.S. this year are likely to push them to new levels this year, they added. The precious metal is expected to touch $2,700 in May or June.

Source: https://e.vnexpress.net/