-

Japan pauses rate hikes; gold surges across the globe

Fri Sep 20 2024

The Bank of Japan signaled an unwillingness to raise interest rates Friday, just months after the central bank raised its key rate for the first time in 17 years. The market reaction caused the Japanese yen to weaken and gold prices to spike. After the announcement, gold gained around 7,000 Japanese yen an ounce, or about 2%.

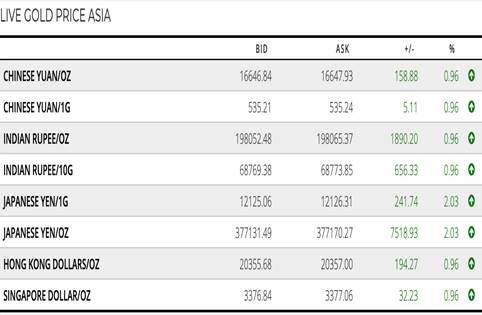

This chart denominated in Japanese yen shows a reaction to the central bank’s decision to pause rate hikes. (Source: Goldprice.org) (credit: PR) Global gold prices also reacted to the news, rising on average about 1%. The yellow metal traded at all-time highs of around $2,615 heading into the opening of U.S. markets on Friday.

Gold has moved higher in four of its last six trading sessions and is on track for the second-straight week to end at new all-time highs.

China gold premiums, purchases drop

New data released this week shows Chinese gold dealers are offering higher discounts in prices, about $12 to $14 under spot, as a reaction to reduced demand. “Price sensitivity in the Asian region has returned and from buyers’ inaction, they seem to be saying that gold is currently overpriced,” analyst Ross Norman told Reuters.

Last week, dealers were offering discounts of about $8 to $10 under spot.

Live gold prices in the asian markets Friday. (Source: Metalsdaily.com) (credit: PR) Swiss gold exports showed no activity from China on the buy side during the month of August, the first time such an event has occurred in three-and-a-half years.

At the same time, gold prices on the Shanghai Gold Exchange dropped below the London price in August, which also hurt the incentive to import gold into China, according to Junlu Liang, senior analyst at consultancy Metals Focus.

India influence continues

Despite the apparent weakening market in China, India picked up some of the slack from its neighbor.

Source: https://www.jpost.com/