-

Gold attracts China's retail investors, lifting prices to new heights

Gold prices have soared to record highs on the arrival of an unexpected group of buyers: retail investors in China."Speculative investors have led most of the past rallies," said Tsutomu Kosuge, president of Tokyo-headquartered commodity research firm Marketedge. "The historic March-April rally is an unusual example of physical demand from China pushing the market higher."

On the New York market, futures are hovering between $2,300 and $2,350 per troy ounce for the most heavily traded contracts. This is up more than 10% from the $2,054.70 closing price at the end of February. Gold futures hit record highs for eight straight trading sessions in early April, touching $2,448.80 at one point.

Exchange-traded funds backed by physical gold experienced net outflows of more than 113 tonnes in the first quarter, according to the World Gold Council -- an eighth straight quarter of outflows. Gold ETFs are usually a draw for speculative funds from Western institutional investors. But long-term interest rates have climbed in the U.S., so institutional investors have apparently pulled funds out of gold, a non-interest-bearing investment.

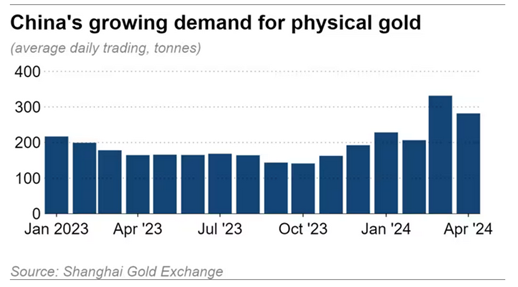

Yet gold prices have risen, leading to market chatter over the identity of the mystery buyers. A hint came in Shanghai Gold Exchange data released Wednesday. The average daily trading volume of gold products during the March-April period came to 613.4 tonnes, up 78.8% on the year.

In April alone, the trading volume was more than double the recent bottom of 141.2 tonnes, recorded in October 2023. China's gold bar and coin demand rose 68% on the year in the first quarter to 110.5 tonnes, the WGC says. Demand from retail investors drove purchases on the SGE, and purchases by dealers looking to stock up on gold and sell on the SGE also boosted prices, according to a market observer.

Funds are flowing into gold "after losing other investment avenues amid the real estate slump and the restrictions imposed on crypto assets and dollar-denominated assets," market analyst Jeff Toshima said.

The People's Bank of China had added to its gold holdings for 18 consecutive months as of April. China and other emerging economies keep gold, a "stateless currency," in their foreign-currency reserves. "Central bank purchases are giving retail investors a sense of reassurance," Toshima said.

The spot price of gold in China has exceeded London's international benchmark since last June. The premium came to $85.60 per troy ounce as of April 1. Yet gold is still being bought in China despite being overpriced relative to other markets.

Chinese retail investors are purchasing gold in a move to "safeguard assets out of concern over currency depreciation," said Takahiro Morita, CEO of commodity market intelligence firm Morita & Associates. This could turn into a long-term trend, Morita said.

Source: https://asia.nikkei.com/