-

It Could Be Time for Silver to Shine Next to Gold

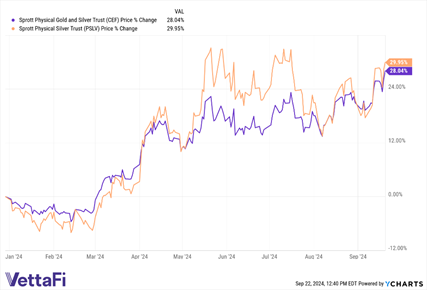

Gold prices are up over 27% so far this year. But silver prices have outpaced its precious metal counterpart, with more than a 30% gain in the same time frame. With so much attention thrown in the direction of the yellow metal, it could time for silver to shine.

One metric that’s indicating a push for silver is the gold-silver ratio, which is derived from dividing the price of the yellow metal by that of silver. The current ratio value could portend to future strength for silver ahead.

“First, silver has slightly outperformed gold this year, but gold prices are still elevated with respect to silver on a historical basis when looking at the so-called gold-silver ratio,” a Yahoo Finance article noted. “When the multiple of gold to silver reaches 80, many investors will look for buying opportunities in silver, betting that the ratio will mean revert.”

Catalysts for Silver’s Growing Attractiveness

Demand for the yellow metal has been driven by central bank buying and other factors earlier in the year. But as market volatility has returned, so has its status as a safe haven asset. Silver can also serve as a precious metal. But its demand could also be due to the move toward reducing global emissions. Silver’s use in clean energy technology makes the metal an attractive option, especially given the growing need for electricity. Big tech’s reliance on electricity to power its AI will also help propel silver.

Given silver’s bright prospects, investors will want to consider the Sprott Physical Silver Trust (PSLV). The fund provides exposure to the precious metal without the additional hassle of storing it. It invests in unencumbered and fully allocated London good delivery silver bars. Additionally, shareholders can redeem their shares for physical bullion anywhere in the world (subject to certain minimum conditions) if they want a more tangible investment experience.

Combining Silver and Gold

It’s difficult to pass over exposure to the yellow metal given its strong momentum alongside silver. Investors can reap the benefits of gold as a store of value while also getting the duality of silver as a precious and industrial metal with a fund that combines exposure to both.

That said, investors may also want to consider the Sprott Physical Gold and Silver Trust (CEF). The fund is a closed-end trust that invests in unencumbered and fully allocated physical gold and silver bullion in LGD bar form. Overall, the goal of CEF is to provide a secure, convenient, and exchange traded investment alternative for investors who want to hold physical gold and silver without the inconvenience typical of a direct investment in physical bullion.

Sour ce: https://www.etftrends.com/