-

Higher gold price eases pressure on producer margins

Thu May 16 2024

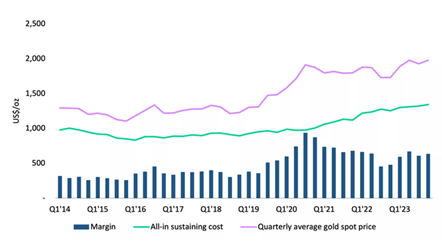

In Q4’23 gold miners’ global average all-in sustaining costs (AISC) rose again, up 2% q/q to US$1,342/oz as persistent cost inflation and a tight labour market continued to influence on-site operating costs. There is a silver lining however, because the rate of increase is slowing and the higher gold price has eased pressure on producer margins. Using the quarterly average spot price of US$1,977/oz, the global average margin in Q4’23 was a relatively healthy US$635/oz, creeping back towards the levels of H1’22, but still some way off the record margins of 2020.

Producer AISC Margins remain fairly robust on the back of the stronger gold price

Quarterly global average AISC, AISC margins and gold price US$/oz*

*Data as of 31 December 2023.

Source: Metals Focus Gold Mines Cost Service

Local inflation within numerous producer countries fell throughout the year. Additionally, oil, natural gas and cyanide prices all trended downwards, which one would expect to have contributed to lower operating costs. Yet any benefit was likely negated by higher employee related costs (a result of the ongoing skills shortage within the industry), continuing elevated prices for some consumables and the strengthening of local currencies against the US dollar. Furthermore, those companies operating in higher risk areas have experienced a rise in their security costs. Consequently, costs continue to fluctuate and regional variations persist.

The average AISC for North America was up 2% q/q to US$1,522/oz in Q4’23. This was the highest of all the regions and continued the upward trend in costs that began in 2017. The average AISC margin for the region was US$454/oz, a rise of 4% q/q but still significantly lower than margins in 2021. Barrick reported a higher q/q AISC at Nevada Gold Mines, underpinned by increased Total Cash Costs (TCC) and sustaining capital expenditure. Newmont recorded increased AISC at Peñasquito as the mine processed lower tonnage and grade during its ramp up following the strike action of Q2 and Q3.

In Oceania the AISC rose by 1% q/q to US$1,132/oz. This led to an average AISC margin of US$692/oz, an increase of 7% q/q. Newmont reported higher q/q AISC at Boddington and Tanami. At Boddington lower grade ore was milled during the quarter and at Tanami the company reported higher direct mining costs. Conversely, Evolution Mining recorded lower AISC at its Cowal operation due to higher grade ore being processed and higher recoveries. Northern Star Resources had a mixed quarter. The KCGM mine had lower AISC as it benefited from the first higher grade ore from Golden Pike North but the Yandal operations were affected by reduced mill availability leading to an increase in AISC.

South America’s average AISC continued to fall in Q4’23, down 3% q/q to US$1,372/oz leading to an average AISC margin for the quarter of US$604/oz. The drop in AISC was underpinned by higher grades processed and an average TCC of US$998/oz. This was the first time the TCC for the region had fallen below US$1,000/oz since Q4’22. At Newmont’s Yanacocha mine in Peru the AISC benefited from higher by-product credits and inventory change. Conversely, AngloGold Ashanti reported a higher AISC at Cerro Vanguardia in Argentina as mine costs were significantly impacted by rampant inflation, which the company reported to be 211.4% by year end, and the weakening of the Argentinian peso.

Costs – and subsequently margins – are expected to remain under pressure in the near term. The Brent Crude oil price increased by 13% between January and mid-April and although it has fallen back a little, it is still trading over US$80/barrel. In some regions the cost of consumables remains high and all regions are subject to rising employee costs as a result of the industry-wide skills shortage.

Source: https://www.gold.org