-

Why are gold prices rising? Chris Wood of Jefferies explains

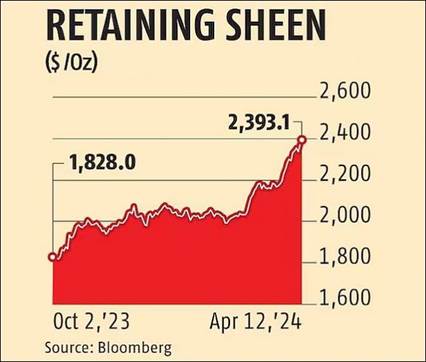

Gold prices have been on an uptrend in the last few months, rising nearly 28 per cent to $2387 per ounce now. This rise in gold price, according to Christopher Wood, global head of equity strategy at Jefferies, is attributed to the demand from China amid lack of investor euphoria as regards the yellow metal.

“Recent developments show a distinct lack of investor euphoria as regards gold, the question remains what is driving the current rally. "The most plausible explanation remains demand from China.

"Still there is a lack of concrete data to confirm such an explanation. "The PBOC has bought gold for 17 months in a row, according to the official foreign reserves data,” Wood wrote in his recent note to investors, GREED & fear.

China’s official gold reserves, Wood said, have increased by 314 tonnes, or 16.1 per cent, from 1,948 tonnes at the end of October 2022 to 2,262 tonnes at the end of March 2024. China’s imports of gold increased by 53 per cent YoY to 372 tonnes in the first two months of 2024.

The other factors that have aided sentiment, according to World Gold Council (WGC), are geopolitics and the actions of the US Federal Reserve (US Fed) in a bid to manage inflation and interest rates.

The Geopolitical Risk (GPR) index, WGC said, moved higher again, as geopolitical tensions emerged across several fronts.

“From a macro perspective - despite heady markets and a soft Fed - there was an important crossover in US data surprises suggesting stagflation risks might be on the rise again, a supportive development for gold prices,” WGC added.

That said, analysts expect gold prices to continue their journey north. Most dips in prices of the yellow metal, said Praveen Singh, associate vice-president for currencies and commodities at Sharekhan by BNP Paribas, are likely to be bought into based on central banks' buying, China's buying, geopolitical tensions and unsustainable US fiscal deficit.

“Valuation is looking somewhat frothy now.

"The US Federal Reserve having committed to rate cuts even when inflation issues linger has given a green light to bulls. Gold prices have support at $2350 / $2320 / $2300, while there is resistance at $2400 / $2450 levels. Overall, gold is eyeing the level of $2600 in this rally,” Singh said.

Key risk

While Wood is impressed that gold has broken out to new highs without any corroborating evidence of ETF inflows in the Western world, the biggest risk, he believes, are 'official attempts' to puncture this rally in gold prices. "While this latter point clearly highlights that there is a risk to the current rally, as does the fact that net long gold speculative positions held by money managers such as hedge funds are up from to 46,400 contracts in mid-February to 178,213 contracts in the week ended April 2, probably the biggest risk remains official attempts to manage the price down," Wood wrote.

Meanwhile, the rising prices of gold have discouraged retail participation. The physical premium on gold bars and coins traded in Singapore, according to Wood, are at only a normal 1-2 per cent compared with the 7-8 per cent levels seen at the peak of the last bull market in 2011 and 2012.

"There is also no evidence of a sudden pickup in sales of American Eagle Bullion coins, one of the most popular series in the US. "American Eagle gold bullion coin sales declined from 19,500 oz in February to 12,000 oz in March, the lowest level for March since 2019.

"This compares with an average of 73,536 oz for the month of March since 2010," Wood said.

Source: https://www.rediff.com/