-

How to Invest in Gold Right Now

Mon May 06 2024

Last month the spot price of gold reached an all-time high at $2,431 an ounce. Since then, the value of bullion has fallen slightly to around $2,300, a range that is still historically high, yielding about 25% over the past seven months.

“Gold has already metabolised the Federal Reserve's expected downsizing of its monetary policy easing outlook for 2024, yet it is continuing its upward trajectory,” explained Ned Naylor-Leyland, manager of Jupiter AM Gold & Silver fund.

“This suggests that other factors are at play, such as the return of significant demand for physical gold, particularly from China and the Middle East. This wave of physical buying could be driven by a confluence of reasons, including inflationary concerns and rising geopolitical tensions in the Middle East.”

Curiously, $15.6 billion of client funds flowed out of precious metals exchange-traded funds (ETCs) over the past year, most recently at a monthly all-time-high rate in April. Amid such profit-taking, those investment vehicles clearly aren't the drivers of globally elevated gold prices.

Who is Buying All this Gold?

China has become one of the most important gold buyers in the world. The China Gold Association (CGA) reported that the country’s gold consumption in 2023 amounted to almost 1,090 tonnes, an increase of 8.73% year-on-year. Another indicator of overall gold demand in China, the Shanghai Gold Exchange (SGE), reported a 95% year-on-year increase in demand in January 2024.

“Behind the record demand from China, an interesting demographic shift is taking place,” Ned Naylor-Leyland continued in his April 30 report. “Younger buyers, aged 25-34, have increased their share of total gold purchases from 16% to 59% in 2023. The decline in the stock market and local property values has contributed to the rise of the younger generation, but it is the form of investment that indicates the true nature of the demographic shift. Younger buyers in China are choosing to buy one-gram gold grains to preserve wealth for the long term.”

Such high demand may be confined to Asia for longer. According to co-founder of Flossbach von Storch Bert Flossbach, in the US, "the real interest rate on inflation-linked bonds is +2% and would have to fall significantly to make gold attractive again to US investors as an inflation hedge.”

On April 22, Flossbach wrote that “it is not possible to make serious predictions about the gold price. Over the past ten years, investors have enjoyed an annual increase in the gold price of more than 8% in euro terms. Looking ahead, we should not expect another similar growth. For us, gold investments are not focused on yield, but on their insurance character as part of a diversified investment strategy.”

Is it Time to Invest in Gold Stocks?

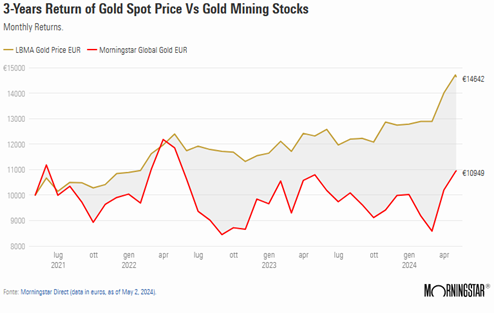

While the value of physical gold has rallied strongly, the share prices of companies that mine and market it have been slow to follow. A simple comparison of two ETFs from the same fund house exposed to these two asset classes, the iShares Physical Gold ETC and the iShares Gold Producers ETF, makes this gap clear: over the past year, the former gained 17.7%, while the latter gained only 2.5%.

On the other hand, something seems to have changed in the past three months, with the iShares ETC on physical gold up 14.4% and the ETF on gold mining company stocks up 20.4%.

Europe-Domiciled Gold Mining Equity ETFs

S&P Commodity Producers Gold NR USD

Gold

★★★★

11.34%

0.55%

1,419

NYSE Arca Gold Miners NR USD

Bronze

★★★★

11.38%

0.53%

880

MVIS Global Junior Gold Miners NR USD

Neutral

★★

10.66%

0.55%

379

NYSE Arca Gold Bugs NR USD

Bronze

★★★

11.29%

0.55%

294

Solactive Gbl Pure Gold Miners NR USD

Silver

★★★

13.52%

0.43%

147

Global Gold Miners TR USD

Gold

★★★★

14.15%

0.65%

131

NYSE Arca Gold Bugs NR EUR

Silver

★★

9.89%

0.65%

61

Solactive AuAg ESG Gold Mining NR USD

Neutral

3.83%

0.60%

45

Source: Morningstar Direct (data in Euros, as of May 2, 2024).

Mining stocks can rise significantly when gold goes up, but this is not always the case. Traditionally, mining stocks are more volatile and amplify the movements of physical gold prices-- their correlation is only visible in the long term.

Gold Stocks Catch Up With Gold Prices

“After years of being undervalued against the yellow metal, the NYSE Arca Gold Miners index and the MVIS Global Juniors Gold Miners index have significantly outperformed gold since March. This could mark the beginning of a long-awaited turnaround for gold mining stocks,” said Imaru Casanova, gold and precious metals portfolio manager at VanEck.

“Outperformers in the sector must also demonstrate fundamental positioning and a solid strategy that translates rising gold prices into improved cash flow and higher returns, which will enable growth,” Casanova continued in his note published on April 30.

“Organic growth is not easy in the gold sector. Searching for new gold deposits or defining/expanding existing ones is a difficult, lengthy and capital-intensive process. To significantly expand their base of reserves and depleting resources, companies generally need to acquire other companies or assets. All things being equal, the more advanced a project is, the higher its valuation and the faster the company grows.”

Source: https://www.morningstar.co.uk