-

Gold rally ends: How to handle gold going forward?

Wed May 15 2024

The narrative of central banks switching from US Treasuries to gold has been fuelling the recent gold price rally. However, gold’s record-breaking rally seems to have run out of steam, at least for now. Impacting both central banks and investors alike, what does the end of the gold rally mean? Our research team takes a closer look.

Key take-aways

- Global gold demand has not grown during the past decade. Rather gold’s record-breaking rally can be explained by an increase in buyers’ willingness to pay.

- All gold-buying central banks increased their holdings of US Treasuries since 2022, except China and Russia who increased gold purchases.

- Gold remains a hedge against economic and systemic risks in financial markets, such as a further weaponisation of the US dollar.

The World Gold Council unveiled broadly unchanged demand for gold in the first quarter of this year. In fact, global gold demand has not grown at all during the past decade. Rather than a big boost to demand, gold’s record-breaking rally can be explained by an increase in buyers’ willingness to pay, spiced up with some speculation.

Central banks: US Treasuries or gold?

Central banks have a higher willingness to pay than Western investors, but their shift out of US Treasuries and into gold seems much less wide spread than perceived.

Prior to 2022, Western investors were almost always the marginal buyers. Since then, demand from Chinese investors, and above all the People’s Bank of China, has picked up. As of today, their willingness to pay also seems much higher than that of Western investors, who are finding more attractively priced safe-haven alternatives in high-grade bonds. Plus, the central banks’ motivation is much more political than economic, which is lifting their willingness to pay.

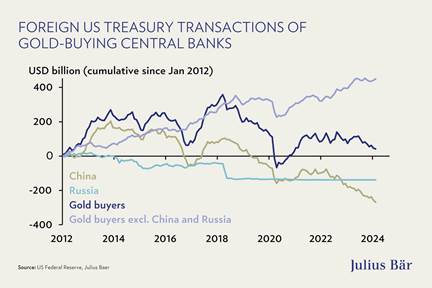

While it is very clear that the People’s Bank of China is reducing its US Treasury holdings to be less dependent on the US dollar – and less susceptible to potential sanctions – the data of foreign US Treasury holdings does not show a broader based shift out of the dollar. Excluding China and Russia, almost all gold-buying central banks have also increased their holdings of US Treasuries since the start of 2022.

All in all, the data is in line with our view of strong Chinese demand and strong central bank buying supporting gold prices on structurally higher levels, but not necessarily pushing them even higher from here.

How to handle gold going forward?

While chasing gold has been one of the favourite pastimes of global investors year to date, from a pure price perspective, we still see more downside than upside in the medium to longer term. From a portfolio perspective, however, gold remains a hedge against economic and systemic risks in financial markets, such as a further weaponisation of the US dollar.

US: Economic cool-down enables lower rates

Weaker US economic data justifies expectations of rate cuts by the Fed. April’s inflation figures should profit from the absence of new cost-push factors, while lagged effects of past ones create considerable uncertainty and volatility around the path of easing inflation. We continue to expect the Fed to start cutting the federal funds target rate at its FOMC meeting on 18 September.

Weaker US economic data has revived expectations of Fed rate cuts. And April’s inflation data has the potential to reinforce this trend and support our expectations of a cut in the fall. Higher gasoline prices are set to keep the monthly increase in the headline consumer price index at a rather high level, while the core rate, which better reflects the underlying inflation trend by excluding volatile and non-cyclical components such as food and energy prices, is expected to show a softer monthly price increase.

US inflation continues to be driven by the lagged effects of past cost-pushes, while there are few signs of new ones. The previously reported cooling of the labour market, which should slow wage growth going forward, and the absence of supply-chain pressures are important confirmations. This means that inflation should slow to 3.4% in April.

Source: https://www.juliusbaer.com/