Page 40 - Bullion World Volume 02 Issue 10 October 2022

P. 40

Bullion World | Volume 2 | Issue 10 | October 2022

International Gold

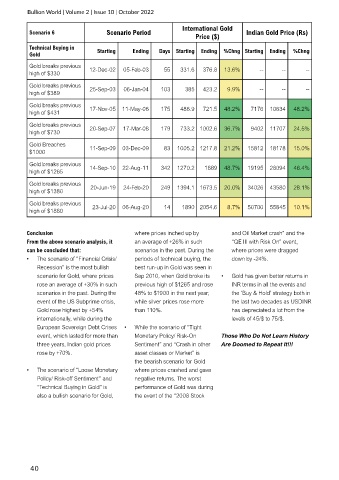

Scenario 6 Scenario Period Indian Gold Price (Rs)

Price ($)

Technical Buying in Starting Ending Days Starting Ending %Chng Starting Ending %Chng

Gold

Gold breaks previous

high of $330 12-Dec-02 05-Feb-03 55 331.6 376.8 13.6% -- -- --

Gold breaks previous 25-Sep-03 06-Jan-04 103 385 423.2 9.9% -- -- --

high of $389

Gold breaks previous 17-Nov-05 11-May-06 175 486.9 721.5 48.2% 7176 10634 48.2%

high of $431

Gold breaks previous

high of $730 20-Sep-07 17-Mar-08 179 733.2 1002.6 36.7% 9402 11707 24.5%

Gold Breaches 11-Sep-09 03-Dec-09 83 1005.2 1217.8 21.2% 15812 18178 15.0%

$1000

Gold breaks previous

high of $1265 14-Sep-10 22-Aug-11 342 1270.2 1889 48.7% 19195 28094 46.4%

Gold breaks previous 20-Jun-19 24-Feb-20 249 1394.1 1673.5 20.0% 34026 43580 28.1%

high of $1380

Gold breaks previous

high of $1880 23-Jul-20 06-Aug-20 14 1890 2054.6 8.7% 50700 55845 10.1%

Conclusion where prices inched up by and Oil Market crash” and the

From the above scenario analysis, it an average of +26% in such “QE III with Risk On” event,

can be concluded that: scenarios in the past. During the where prices were dragged

• The scenario of “Financial Crisis/ periods of technical buying, the down by -24%.

Recession” is the most bullish best run-up in Gold was seen in

scenario for Gold, where prices Sep 2010, when Gold broke its • Gold has given better returns in

rose an average of +30% in such previous high of $1265 and rose INR terms in all the events and

scenarios in the past. During the 48% to $1900 in the next year, the ‘Buy & Hold’ strategy both in

event of the US Subprime crisis, while silver prices rose more the last two decades as USDINR

Gold rose highest by +54% than 110%. has depreciated a lot from the

internationally, while during the levels of 45/$ to 75/$.

European Sovereign Debt Crises • While the scenario of “Tight

event, which lasted for more than Monetary Policy/ Risk-On Those Who Do Not Learn History

three years, Indian gold prices Sentiment” and “Crash in other Are Doomed to Repeat It!!!

rose by +70%. asset classes or Market” is

the bearish scenario for Gold

• The scenario of “Loose Monetary where prices crashed and gave

Policy/ Risk-off Sentiment” and negative returns. The worst

“Technical Buying in Gold” is performance of Gold was during

also a bullish scenario for Gold, the event of the “2008 Stock

40