-

Silver’s bullish break under threat with aggressive sellers parked above

Tue June 25 2024

- Silver finds itself perched above a key support zone

- Price action points to aggressive sellers parked just above these levels

- The support zone can be used to build a trade around, regardless of how the price evolves

- US core PCE inflation report is the key macro event this week

Silver teetering above support zone

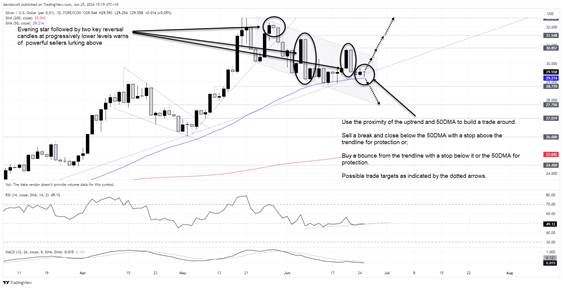

It could be an important day for silver, threatening to break the uptrend that kicked off the bullish run back in February. Given its importance, it comes across as an ideal level to build a trade around, regardless of how the price action evolves from here.

I’m not going to preempt which way the price will break, although the series of topping patterns at progressively lower levels in June – an evening star followed by two ugly bearish engulfing candles – warns there may be big sellers lurking not far above these levels.

For now, you can see silver is resting on uptrend support having pushed below it earlier today, the reversal possibly reflecting the proximity of the 50-day moving average which acted as support earlier in June.

Sell the break…

Should the price break and close below the uptrend and 50-day moving average, you could sell with stop loss above the trendline for protection. The initial target would be $28.77, a level that has acted as both support and resistance since early May. $27.622 is another potential target, coinciding with horizontal support and the bottom of the bull flag silver currently finds itself in.

Even though the price action in June warns of a growing risk of a bearish break, that doesn’t mean such a scenario will materialise. I’ll therefore wait for the price to tell me how to proceed.

…or buy the bounce

Should uptrend support hold, you could buy with a stop loss below either the uptrend or 50-day moving average, depending on your risk tolerance and trade target. The first upside target would be the top of the bull flag, currently found at $30.50. If that were to give way, $30.857, $31.548 and May highs above $32.50 would be the next levels to watch.

Key event risk looms

As for key drivers in the days ahead, it’s hard to go past the US core PCE deflator on Friday given the implications for the Fed rate outlook and US dollar. From a fundamental perspective, silver and other noninterest-bearing assets would normally benefit from a weaker greenback and lower US borrowing costs, creating tailwinds from a FX perspective and reducing the opportunity cost of holding long silver positions.

Source: https://www.forex.com/