-

This brokerage believes silver may outperform gold in long-term

Motilal Oswal Financial Services Limited (MOFSL) has forecasted that silver could outshine gold in the long run. The brokerage cited data indicating year-to-date increases for both precious metals.

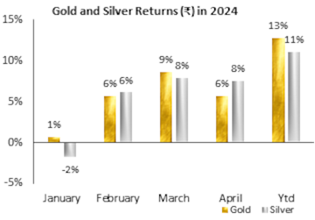

According to MOFSL, gold and silver have experienced year-to-date gains of 13% and 11% respectively, since the commencement of the new year with the auspicious occasion of Akshaya Tritiya.

(Source: Motilal Oswal)

MOFSL continues to advocate a positive outlook for both gold and silver.

It recommends purchasing the metals on dips with targets set at ₹75,000 per 10 grams for gold and ₹1 lakh for silver on the domestic front, and $2450 per ounce for gold and $34 for silver on Comex.

Despite the positive outlook, some factors could temper gold prices, including supply and demand issues, particularly during periods of extreme uncertainty in the market.MOFSL highlights a range of factors that could act as tailwinds for gold prices, including lower-than-expected economic data, rising growth concerns, increased rate cut expectations, geopolitical tensions, concerns regarding rising debt, increased demand, and falling US yields.

Moreover, the volatility in election years, with more than 40 countries, including the US and India, lined up for elections, could further impact gold prices.

Market participants often anticipate future events in advance, potentially leading to further support for gold prices in the face of unexpected occurrences.

The surge in gold and silver prices since the beginning of the year has been attributed to several factors, including geopolitical tensions and uncertainty surrounding the Federal Reserve's monetary policy.

Central banks' continued purchases of gold in Q1, along with increased demand for bars and coins, indicate sustained interest in the precious metal.

Notably, imports of gold and silver have seen a significant increase since the start of the year, possibly influenced by trade deals and import duty benefits.

Looking at historical data, gold has delivered a consistent 10% compound annual growth rate (CAGR) over the last 15 years for Akshaya Tritiya, making it an attractive investment option for market participants with varying risk profiles.

In the longer term, MOFSL recommends investing in Sovereign Gold Bonds (SGBs) to capitalise on gold price rises, with the added benefit of a 2.5% interest rate.

Other investment options include ETFs, exchange-traded derivatives, digital gold, and physical bars and coins.Source: https://www.cnbctv18.com/