Page 41 - Bullion World Volume 03 Issue 6 June 2023

P. 41

Bullion World | Volume 3 | Issue 6 | June 2023

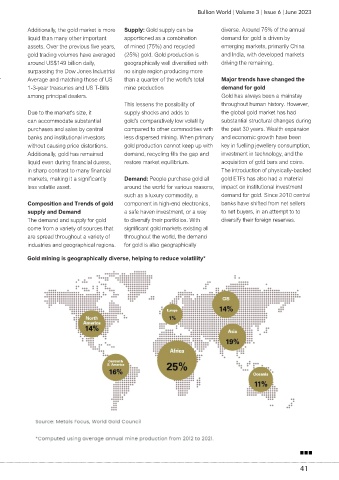

Additionally, the gold market is more Supply: Gold supply can be diverse. Around 75% of the annual

liquid than many other important apportioned as a combination demand for gold is driven by

assets. Over the previous five years, of mined (75%) and recycled emerging markets, primarily China

gold trading volumes have averaged (25%) gold. Gold production is and India, with developed markets

around US$149 billion daily, geographically well diversified with driving the remaining.

surpassing the Dow Jones Industrial no single region producing more

Average and matching those of US than a quarter of the world's total Major trends have changed the

1-3-year treasuries and US T-Bills mine production demand for gold

among principal dealers. Gold has always been a mainstay

This lessens the possibility of throughout human history. However,

Due to the market's size, it supply shocks and adds to the global gold market has had

can accommodate substantial gold's comparatively low volatility substantial structural changes during

purchases and sales by central compared to other commodities with the past 30 years. Wealth expansion

banks and institutional investors less dispersed mining. When primary and economic growth have been

without causing price distortions. gold production cannot keep up with key in fuelling jewellery consumption,

Additionally, gold has remained demand, recycling fills the gap and investment in technology, and the

liquid even during financial duress, restore market equilibrium. acquisition of gold bars and coins.

in sharp contrast to many financial The introduction of physically-backed

markets, making it a significantly Demand: People purchase gold all gold ETFs has also had a material

less volatile asset. around the world for various reasons, impact on institutional investment

such as a luxury commodity, a demand for gold. Since 2010 central

Composition and Trends of gold component in high-end electronics, banks have shifted from net sellers

supply and Demand a safe haven investment, or a way to net buyers, in an attempt to to

The demand and supply for gold to diversify their portfolios. With diversify their foreign reserves.

come from a variety of sources that significant gold markets existing all

are spread throughout a variety of throughout the world, the demand

industries and geographical regions. for gold is also geographically

Gold mining is geographically diverse, helping to reduce volatility*

41