Page 40 - Bullion World Volume 03 Issue 6 June 2023

P. 40

Bullion World | Volume 3 | Issue 6 | June 2023

Gold: A scarce asset with a large market-

World Gold Council

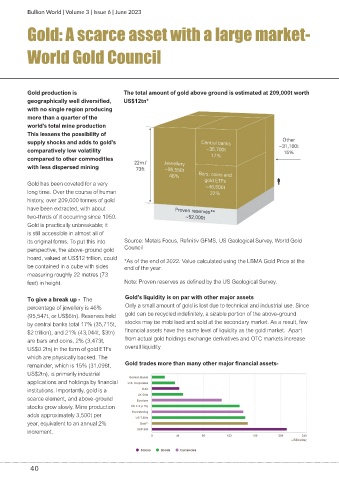

Gold production is The total amount of gold above ground is estimated at 209,000t worth

geographically well diversified, US$12tn*

with no single region producing

more than a quarter of the

world's total mine production

This lessens the possibility of

supply shocks and adds to gold's

comparatively low volatility

compared to other commodities

with less dispersed mining

Gold has been coveted for a very

long time. Over the course of human

history, over 209,000 tonnes of gold

have been extracted, with about

two-thirds of it occurring since 1950.

Gold is practically unbreakable; it

is still accessible in almost all of

its original forms. To put this into Source: Metals Focus, Refinitiv GFMS, US Geological Survey, World Gold

perspective, the above-ground gold Council

hoard, valued at US$12 trillion, could *As of the end of 2022. Value calculated using the LBMA Gold Price at the

be contained in a cube with sides end of the year.

measuring roughly 22 metres (73

feet) in height. Note: Proven reserves as defined by the US Geological Survey.

To give a break up - The Gold's liquidity is on par with other major assets

percentage of jewellery is 46% Only a small amount of gold is lost due to technical and industrial use. Since

(95,547t, or US$6tn). Reserves held gold can be recycled indefinitely, a sizable portion of the above-ground

by central banks total 17% (35,715t, stocks may be mobilised and sold at the secondary market. As a result, few

$2 trillion), and 21% (43,044t, $3tn) financial assets have the same level of liquidity as the gold market. Apart

are bars and coins, 2% (3,473t, from actual gold holdings exchange derivatives and OTC markets increase

US$0.2tn) in the form of gold ETFs overall liquidity

which are physically backed. The

remainder, which is 15% (31,096t, Gold trades more than many other major financial assets-

US$2tn), is primarily industrial

applications and holdings by financial

institutions. Importantly, gold is a

scarce element, and above-ground

stocks grow slowly. Mine production

adds approximately 3,500t per

year, equivalent to an annual 2%

increment.

40