Page 26 - Bullion World Volume 4 Issue 1 January 2024

P. 26

Bullion World | Volume 4 | Issue 1 | January 2024

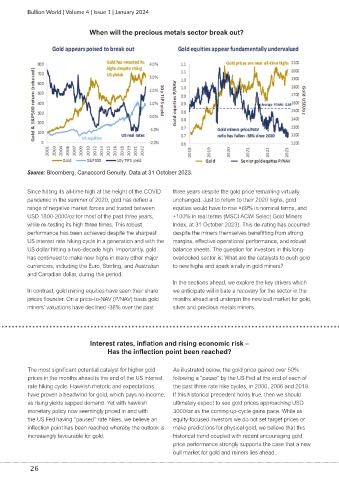

When will the precious metals sector break out?

Source: Bloomberg, Canaccord Genuity. Data at 31 October 2023.

Since hitting its all-time high at the height of the COVID three years despite the gold price remaining virtually

pandemic in the summer of 2020, gold has defied a unchanged. Just to return to their 2020 highs, gold

range of negative market forces and traded between equities would have to rise +69% in nominal terms, and

USD 1800-2000/oz for most of the past three years, +100% in real terms (MSCI ACWI Select Gold Miners

while re-testing its high three times. This robust Index, at 31 October 2023). This de-rating has occurred

performance has been achieved despite the sharpest despite the miners themselves benefitting from strong

US interest rate hiking cycle in a generation and with the margins, effective operational performance, and robust

US dollar hitting a two-decade high. Importantly, gold balance sheets. The question for investors in this long-

has continued to make new highs in many other major overlooked sector is: What are the catalysts to push gold

currencies, including the Euro, Sterling, and Australian to new highs and spark a rally in gold miners?

and Canadian dollar, during this period.

In the sections ahead, we explore the key drivers which

In contrast, gold mining equities have seen their share we anticipate will initiate a recovery for the sector in the

prices flounder. On a price-to-NAV (P/NAV) basis gold months ahead and underpin the new bull market for gold,

miners’ valuations have declined -38% over the past silver and precious metals miners.

Interest rates, inflation and rising economic risk –

Has the inflection point been reached?

The most significant potential catalyst for higher gold As illustrated below, the gold price gained over 50%

prices in the months ahead is the end of the US interest following a “pause” by the US Fed at the end of each of

rate hiking cycle. Hawkish rhetoric and expectations the past three rate hike cycles, in 2000, 2006 and 2019.

have proven a headwind for gold, which pays no income, If this historical precedent holds true, then we should

as rising yields sapped demand. Yet with hawkish ultimately expect to see gold prices approaching USD

monetary policy now seemingly priced in and with 3000/oz as the coming up-cycle gains pace. While as

the US Fed having “paused” rate hikes, we believe an equity-focused investors we do not set target prices or

inflection point has been reached whereby the outlook is make predictions for physical gold, we believe that this

increasingly favourable for gold. historical trend coupled with recent encouraging gold

price performance strongly supports the case that a new

bull market for gold and miners lies ahead.

26