Page 28 - Bullion World Volume 4 Issue 1 January 2024

P. 28

Bullion World | Volume 4 | Issue 1 | January 2024

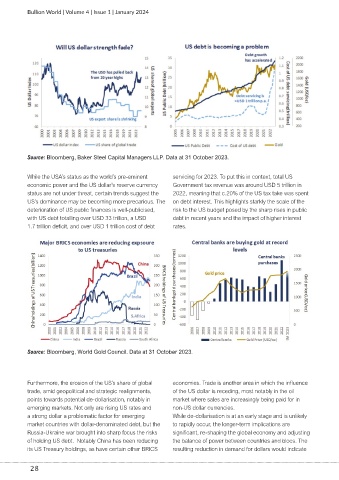

Source: Bloomberg, Baker Steel Capital Managers LLP. Data at 31 October 2023.

While the USA’s status as the world’s pre-eminent servicing for 2023. To put this in context, total US

economic power and the US dollar’s reserve currency Government tax revenue was around USD 5 trillion in

status are not under threat, certain trends suggest the 2022, meaning that c.20% of the US tax take was spent

US’s dominance may be becoming more precarious. The on debt interest. This highlights starkly the scale of the

deterioration of US public finances is well-publicised, risk to the US budget posed by the sharp rises in public

with US debt totalling over USD 33 trillion, a USD debt in recent years and the impact of higher interest

1.7 trillion deficit, and over USD 1 trillion cost of debt rates.

Source: Bloomberg, World Gold Council. Data at 31 October 2023.

Furthermore, the erosion of the US’s share of global economies. Trade is another area in which the influence

trade, amid geopolitical and strategic realignments, of the US dollar is receding, most notably in the oil

points towards potential de-dollarisation, notably in market where sales are increasingly being paid for in

emerging markets. Not only are rising US rates and non-US dollar currencies.

a strong dollar a problematic factor for emerging While de-dollarisation is at an early stage and is unlikely

market countries with dollar-denominated debt, but the to rapidly occur, the longer-term implications are

Russia-Ukraine war brought into sharp focus the risks significant, re-shaping the global economy and adjusting

of holding US debt. Notably China has been reducing the balance of power between countries and blocs. The

its US Treasury holdings, as have certain other BRICS resulting reduction in demand for dollars would indicate

28