Page 21 - Bullion World Volume 4 Issue 1 January 2024

P. 21

Bullion World | Volume 4 | Issue 1 | January 2024

election, too, stokes uncertainty, keeping financial 2022-23, we estimate they will remain above an average

markets volatile and supporting gold demand. of 800 tonnes. This should mitigate any weakness in

demand for gold jewellery due to higher prices.

Elevated geopolitical risks have been driving gold buying

since early 2022 and are likely to persist in 2024, with In summary, easier monetary conditions in 2024 could

the war in Ukraine continuing, ongoing strain in the boost investors’ demand for gold, alongside steady

Middle East situation, and discord between the US and central bank buying. Investor positioning is light, as gold

China. We estimate a geopolitical risk premium of nearly ETF holdings recorded outflows of 280 tonnes in 2023. A

7-8% is embedded in prices, which will likely sustain in pivot to rate cuts indicates an opportunity for investors to

2024. build on these positions again.

While we see gold prices being well supported in 2024,

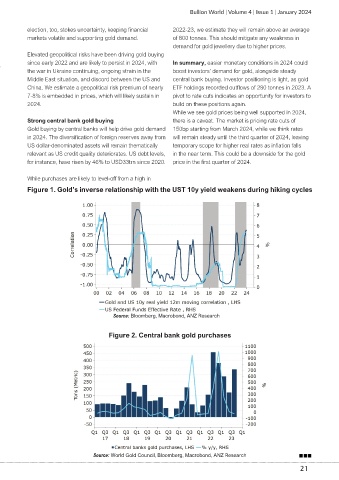

Strong central bank gold buying there is a caveat. The market is pricing rate cuts of

Gold buying by central banks will help drive gold demand 150bp starting from March 2024, while we think rates

in 2024. The diversification of foreign reserves away from will remain steady until the third quarter of 2024, leaving

US dollar-denominated assets will remain thematically temporary scope for higher real rates as inflation falls

relevant as US credit quality deteriorates. US debt levels, in the near term. This could be a downside for the gold

for instance, have risen by 46% to USD33trn since 2020. price in the first quarter of 2024.

While purchases are likely to level-off from a high in

Figure 1. Gold’s inverse relationship with the UST 10y yield weakens during hiking cycles

Source: Bloomberg, Macrobond, ANZ Research

Figure 2. Central bank gold purchases

Source: World Gold Council, Bloomberg, Macrobond, ANZ Research

21