Page 19 - Bullion World Volume 3 Issue 11 November 2023

P. 19

Bullion World | Volume 3 | Issue 11 | November 2023

The economic benefits of India becoming a “net exporter” of Bullion thru strengthening of its refining sector can be

summarised as follows:

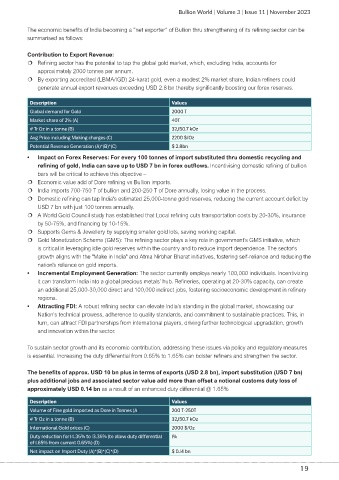

Contribution to Export Revenue:

Refining sector has the potential to tap the global gold market, which, excluding India, accounts for

approximately 2000 tonnes per annum.

By exporting accredited (LBMA/IGD) 24-karat gold, even a modest 2% market share, Indian refiners could

generate annual export revenues exceeding USD 2.8 bn thereby significantly boosting our forex reserves.

Description Values

Global demand for Gold 2000 T

Market share of 2% (A) 40T

# Tr Oz in a tonne (B) 32,150.7 kOz

Avg Price including Making charges (C) 2200 $/Oz

Potential Revenue Generation (A)*(B)*(C) $ 2.8bn

• Impact on Forex Reserves: For every 100 tonnes of import substituted thru domestic recycling and

refining of gold, India can save up to USD 7 bn in forex outflows. Incentivising domestic refining of bullion

bars will be critical to achieve this objective –

Economic value add of Dore refining vs Bullion imports.

India imports 700-750 T of bullion and 200-250 T of Dore annually, losing value in the process.

Domestic refining can tap India's estimated 25,000-tonne gold reserves, reducing the current account deficit by

USD 7 bn with just 100 tonnes annually.

A World Gold Council study has established that Local refining cuts transportation costs by 20-30%, insurance

by 50-75%, and financing by 10-15%.

Supports Gems & Jewellery by supplying smaller gold lots, saving working capital.

Gold Monetization Scheme (GMS): The refining sector plays a key role in government's GMS initiative, which

is critical in leveraging idle gold reserves within the country and to reduce import dependence. The sector's

growth aligns with the "Make in India" and Atma Nirbhar Bharat initiatives, fostering self-reliance and reducing the

nation's reliance on gold imports.

• Incremental Employment Generation: The sector currently employs nearly 100,000 individuals. Incentivizing

it can transform India into a global precious metals’ hub. Refineries, operating at 20-30% capacity, can create

an additional 25,000-30,000 direct and 100,000 indirect jobs, fostering socioeconomic development in refinery

regions.

• Attracting FDI: A robust refining sector can elevate India's standing in the global market, showcasing our

Nation's technical prowess, adherence to quality standards, and commitment to sustainable practices. This, in

turn, can attract FDI partnerships from international players, driving further technological upgradation, growth

and innovation within the sector.

To sustain sector growth and its economic contribution, addressing these issues via policy and regulatory measures

is essential. Increasing the duty differential from 0.65% to 1.65% can bolster refiners and strengthen the sector.

The benefits of approx. USD 10 bn plus in terms of exports (USD 2.8 bn), import substitution (USD 7 bn)

plus additional jobs and associated sector value add more than offset a notional customs duty loss of

approximately USD 0.14 bn as a result of an enhanced duty differential @ 1.65%

Description Values

Volume of Fine gold imported as Dore in Tonnes (A) 200 T-250T

# Tr Oz in a tonne (B) 32,150.7 kOz

International Gold prices (C) 2000 $/Oz

Duty reduction for 14.35% to 13.35% (to allow duty differential 1%

of 1.65% from current 0.65%) (D)

Net impact on Import Duty (A)*(B)*(C)*(D) $ 0.14 bn

19