Page 18 - Bullion World Volume 3 Issue 11 November 2023

P. 18

Bullion World | Volume 3 | Issue 11 | November 2023

Over the past decade, our domestic gold refiners have been facing a substantial decline in their net margins. In the

fiscal year 2012-13, the net margin for domestic refiners stood at a robust 1.65% (Annexture 1), reflecting a healthy

industry.

However, the situation has become considerably more challenging, with the net margin decline to 0.20% (Annexture

1) in the fiscal year 2022-23.

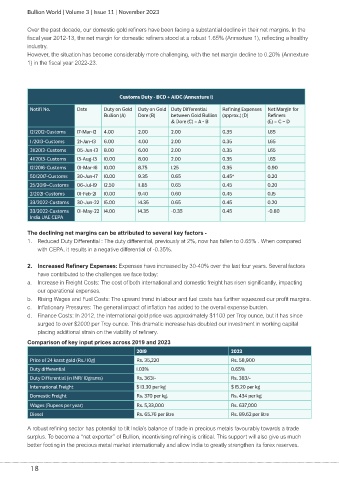

Customs Duty - BCD + AIDC (Annexture 1)

Notifi No. Date Duty on Gold Duty on Gold Duty Differential Refining Expenses Net Margin for

Bullion (A) Dore (B) between Gold Bullion (approx.) (D) Refiners

& Dore (C) = A - B (E) = C – D

12/2012-Customs 17-Mar-12 4.00 2.00 2.00 0.35 1.65

1 /2013-Customs 21-Jan-13 6.00 4.00 2.00 0.35 1.65

31/2013-Customs 05-Jun-13 8.00 6.00 2.00 0.35 1.65

41/2013-Customs 13-Aug-13 10.00 8.00 2.00 0.35 1.65

12/2016-Customs 01-Mar-16 10.00 8.75 1.25 0.35 0.90

50/2017-Customs 30-Jun-17 10.00 9.35 0.65 0.45* 0.20

25/2019–Customs 06-Jul-19 12.50 11.85 0.65 0.45 0.20

2/2021-Customs 01-Feb-21 10.00 9.40 0.60 0.45 0.15

33/2022-Customs 30-Jun-22 15.00 14.35 0.65 0.45 0.20

33/2022-Customs 01-May-22 14.00 14.35 -0.35 0.45 -0.80

India UAE CEPA

The declining net margins can be attributed to several key factors -

1. Reduced Duty Differential : The duty differential, previously at 2%, now has fallen to 0.65% . When compared

with CEPA, it results in a negative differential of -0.35%.

2. Increased Refinery Expenses: Expenses have increased by 30-40% over the last four years. Several factors

have contributed to the challenges we face today:

a. Increase in Freight Costs: The cost of both international and domestic freight has risen significantly, impacting

our operational expenses.

b. Rising Wages and Fuel Costs: The upward trend in labour and fuel costs has further squeezed our profit margins.

c. Inflationary Pressures: The general impact of inflation has added to the overall expense burden.

d. Finance Costs: In 2012, the international gold price was approximately $1100 per Troy ounce, but it has since

surged to over $2000 per Troy ounce. This dramatic increase has doubled our investment in working capital

placing additional strain on the viability of refinery.

Comparison of key input prices across 2019 and 2023

2019 2023

Price of 24 karat gold (Rs./ 10g) Rs. 35,220 Rs. 58,900

Duty differential 1.03% 0.65%

Duty Differential (in INR/ 10grams) Rs. 363/- Rs. 383/-

International Freight $ 13.30 per kg $ 15.20 per kg

Domestic Freight Rs. 370 per kg. Rs. 434 per kg

Wages (Rupees per year) Rs. 5,33,000 Rs. 637,000

Diesel Rs. 65.76 per litre Rs. 89.62 per litre

A robust refining sector has potential to tilt India’s balance of trade in precious metals favourably towards a trade

surplus. To become a “net exporter” of Bullion, incentivising refining is critical. This support will also give us much

better footing in the precious metal market internationally and allow India to greatly strengthen its forex reserves.

18