Page 16 - Bullion World Volume 4 Issue 10 October 2024

P. 16

Bullion World | Volume 4 | Issue 10 | October 2024

So while the demand profiles for palladium and rhodium Nornickel, the world’s largest palladium producer, has

are threatened, long-term forecasts are fraught with reported that it is ahead of its 2024 production schedule

uncertainties. What we can say is that, worst case, by although Red Sea navigation issues mean that it has had

the late 2030s an industry that currently comprises 80% to increase its inventories. Amplats and Implats in South

of palladium demand could be becoming a net supplier Africa, meanwhile, are working off some of the inventory

of metal into the market. of untreated material that built up during load shedding.

On the supply-side, the palladium and rhodium price Platinum is likely to post a deficit this year equivalent to

falls, and issues with supply of South African energy, are roughly two weeks’ global industrial demand and three

still key issues. Load-shedding in South Africa ceased weeks’ in 2025; palladium looks like a six-week deficit

on 1st April, although the CEO of Eskom, the State this year and five weeks’ in 2025.

energy supplier, has warned that outstanding large bills

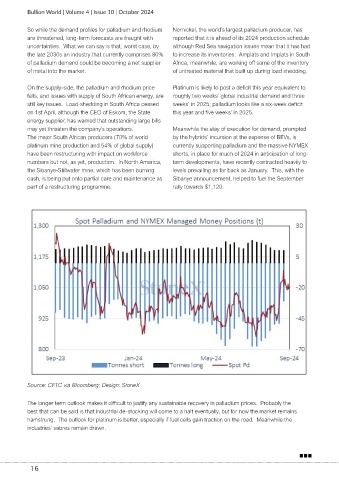

may yet threaten the company’s operations. Meanwhile the stay of execution for demand, prompted

The major South African producers (70% of world by the hybrids’ incursion at the expense of BEVs, is

platinum mine production and 54% of global supply) currently supporting palladium and the massive NYMEX

have been restructuring with impact on workforce shorts, in place for much of 2024 in anticipation of long-

numbers but not, as yet, production. In North America, term developments, have recently contracted heavily to

the Sibanye-Stillwater mine, which has been burning levels prevailing as far back as January. This, with the

cash, is being put onto partial care and maintenance as Sibanye announcement, helped to fuel the September

part of a restructuring programme. rally towards $1,120.

Source: CFTC via Bloomberg; Design: StoneX

The longer term outlook makes it difficult to justify any sustainable recovery in palladium prices. Probably the

best that can be said is that industrial de-stocking will come to a halt eventually, but for now the market remains

hamstrung. The outlook for platinum is better, especially if fuel cells gain traction on the road. Meanwhile the

industries’ sabres remain drawn.

16