Page 20 - Bullion World Volume 4 Issue 11 November 2024

P. 20

Bullion World | Volume 4 | Issue 11 | November 2024

B ullion W orld | V olume 4 | I ssue 11 | N o v ember 2024

Can Platinum Market

Deficits be Met by

ETFs? Yes, But only

at Much Higher Prices

By the World Platinum Investment Council

In our updated two-to-five-year platinum market outlook, not price agnostic. By calculating the weighted average

we expect platinum market deficits to average 769 koz cost of metal held in ETFs, it is possible to estimate a

from 2025f to 2028f. Drawing on above ground stocks price threshold required for metal to be sold.

(AGS) will be needed to supply the market, however,

these are expected to be depleted during 2028f. Palladium illustrates that the weighted average cost

A common argument is that despite depleting AGS, of ETF holdings is broadly the threshold at which ETF

platinum prices will not respond to consecutive years disposals occur in a market expecting consecutive

of market deficits, since ETF disposals will fulfil metal years of deficits. From 2015 to 2020, palladium prices

shortfalls. tripled, and ETF holdings declined from 3.0 Moz to

0.6 Moz. However, most disposals occurred after spot

Platinum ETFs launched in 2007 and have accumulated prices exceeded the weighted average cost of ETF

around 3.2 Moz of physically backed holdings. This has holdings (Fig. 2). Accordingly, unless the platinum price

supported platinum demand, but vice versa, disposals sustainably trends above US$1,100/oz, we do not

would result in ETFs acting as a source of supply. anticipate large outflows and believe market deficits will

However, it is often ignored that platinum ETF demand only be met through the depletion of AGS. This could be

stems from investors seeking a return on capital via compounded by the ongoing interest rate downcycle,

platinum price appreciation. Hence, ETF disposals are which improves the competitiveness of non-yielding

assets like commodity ETFs.

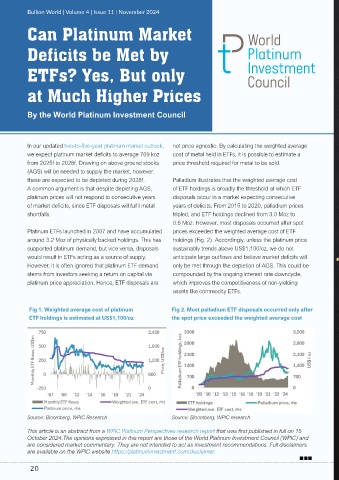

Fig 1. Weighted average cost of platinum Fig 2. Most palladium ETF disposals occurred only after

ETF holdings is estimated at US$1,100/oz the spot price exceeded the weighted average cost

FOR OVER A CENTURY WE HAVE

RESHAPED VALUE RESPONSIBLY

Source: Bloomberg, WPIC Research Source: Bloomberg, WPIC research

This article is an abstract from a WPIC Platinum Perspectives research report that was first published in full on 15

October 2024.The opinions expressed in this report are those of the World Platinum Investment Council (WPIC) and

are considered market commentary. They are not intended to act as investment recommendations. Full disclaimers

are available on the WPIC website https://platinuminvestment.com/disclaimer. www.randrefinery.com

20

20