Page 43 - Bollion World Volume 4 Issue 8 August 2024

P. 43

Bullion World | Volume 4 | Issue 8 | August 2024

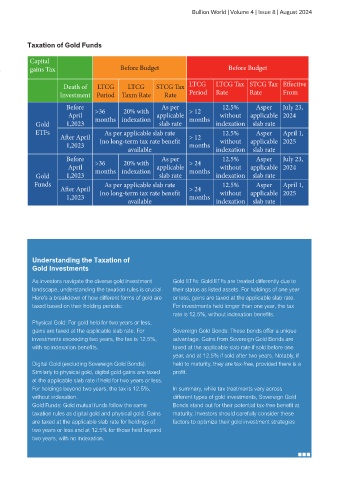

Taxation of Gold Funds

Capital

gains Tax Before Budget Before Budget

Death of LTCG LTCG STCG Tax LTCG LTCG Tax STCG Tax Effective

Investment Period Taxm Rate Rate Period Rate Rate From

Before >36 20% with As per > 12 12.5% Asper July 23,

April applicable without applicable 2024

Gold 1,2023 months indexation slab rate months indexation slab rate

ETFs As per applicable slab rate 12.5% Asper April 1,

After April (no long-term tax rate benefit > 12 without applicable 2025

1,2023 months

available indexation slab rate

Before >36 20% with As per > 24 12.5% Asper July 23,

April months indexation applicable months without applicable 2024

Gold 1,2023 slab rate indexation slab rate

Funds As per applicable slab rate 12.5% Asper April 1,

After April > 24

1,2023 (no long-term tax rate benefit months without applicable 2025

available indexation slab rate

Understanding the Taxation of

Gold Investments

As investors navigate the diverse gold investment Gold ETFs: Gold ETFs are treated differently due to

landscape, understanding the taxation rules is crucial. their status as listed assets. For holdings of one year

Here's a breakdown of how different forms of gold are or less, gains are taxed at the applicable slab rate.

taxed based on their holding periods: For investments held longer than one year, the tax

rate is 12.5%, without indexation benefits.

Physical Gold: For gold held for two years or less,

gains are taxed at the applicable slab rate. For Sovereign Gold Bonds: These bonds offer a unique

investments exceeding two years, the tax is 12.5%, advantage. Gains from Sovereign Gold Bonds are

with no indexation benefits. taxed at the applicable slab rate if sold before one

year, and at 12.5% if sold after two years. Notably, if

Digital Gold (excluding Sovereign Gold Bonds): held to maturity, they are tax-free, provided there is a

Similarly to physical gold, digital gold gains are taxed profit.

at the applicable slab rate if held for two years or less.

For holdings beyond two years, the tax is 12.5%, In summary, while tax treatments vary across

without indexation. different types of gold investments, Sovereign Gold

Gold Funds: Gold mutual funds follow the same Bonds stand out for their potential tax-free benefit at

taxation rules as digital gold and physical gold. Gains maturity. Investors should carefully consider these

are taxed at the applicable slab rate for holdings of factors to optimize their gold investment strategies

two years or less and at 12.5% for those held beyond

two years, with no indexation.