Page 42 - Bollion World Volume 4 Issue 8 August 2024

P. 42

Bullion World | Volume 4 | Issue 8 | August 2024

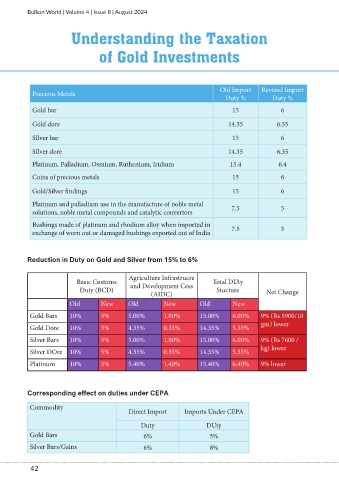

Understanding the Taxation

of Gold Investments

Old Import Revised Import

Precious Metals

Duty % Duty %

Gold bar 15 6

Gold dore 14.35 6.35

SIlver bar 15 6

SIlver dore 14.35 6.35

Platinum, Palladium, Osmium, Ruthenium, Iridium 15.4 6.4

Coins of precious metals 15 6

Gold/Silver findings 15 6

Platinum and palladium use in the manufacture of noble metal 7.5 5

solutions, noble metal compounds and catalytic convertors

Bushings made of platinum and rhodium alloy when imported in 7.5 5

exchange of worn out or damaged bushings exported out of India

Reduction in Duty on Gold and Silver from 15% to 6%

Agriculture Infrastrucre

Basic Customs and Development Cess Total DUty

Duty (BCD) Stucture Net Change

(AIDC)

Old New Old New Old New

Gold Bars 10% 5% 5.00% 1.00% 15.00% 6.00% 9% (Rs 5900/10

gm) lower

Gold Dore 10% 5% 4.35% 0.35% 14.35% 5.35%

Silver Bars 10% 5% 5.00% 1.00% 15.00% 6.00% 9% (Rs 7600 /

kg) lower

Silver DOre 10% 5% 4.35% 0.35% 14.35% 5.35%

Platinum 10% 5% 5.40% 1.40% 15.40% 6.40% 9% lower

Corresponding effect on duties under CEPA

Commodity

Direct Import Imports Under CEPA

Duty DUty

Gold Bars 6% 5%

Silver Bars/Gains 6% 8%

42