Page 29 - Bullion World Volume 4 Issue 4 April 2024

P. 29

Bullion World | Volume 4 | Issue 4 | April 2024

According to the supply scenario for silver, mine production has been gradually declining till 2022, while scrap

availability and scarp inflow have been steadily rising over the past few years. The impact of COVID-19 was also

a factor, as many mines had been closing down or producing less, but more recently, many of them had resumed

operations at full capacity or had even expanded.

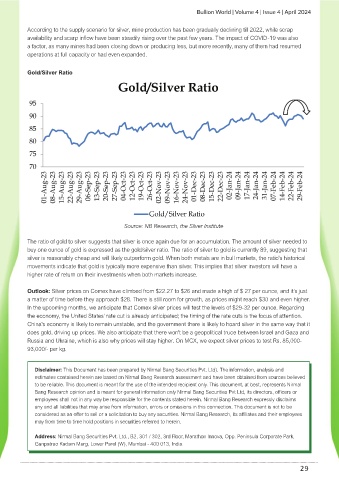

Gold/Silver Ratio

Source: NB Research, the Silver Institute

The ratio of gold to silver suggests that silver is once again due for an accumulation. The amount of silver needed to

buy one ounce of gold is expressed as the gold/silver ratio. The ratio of silver to gold is currently 89, suggesting that

silver is reasonably cheap and will likely outperform gold. When both metals are in bull markets, the ratio's historical

movements indicate that gold is typically more expensive than silver. This implies that silver investors will have a

higher rate of return on their investments when both markets increase.

Outlook: Silver prices on Comex have climbed from $22.27 to $26 and made a high of $ 27 per ounce, and it's just

a matter of time before they approach $28. There is still room for growth, as prices might reach $30 and even higher.

In the upcoming months, we anticipate that Comex silver prices will test the levels of $29-32 per ounce. Regarding

the economy, the United States' rate cut is already anticipated; the timing of the rate cuts is the focus of attention.

China's economy is likely to remain unstable, and the government there is likely to hoard silver in the same way that it

does gold, driving up prices. We also anticipate that there won't be a geopolitical truce between Israel and Gaza and

Russia and Ukraine, which is also why prices will stay higher. On MCX, we expect silver prices to test Rs. 85,000-

93,000/- per kg.

Disclaimer: This Document has been prepared by Nirmal Bang Securities Pvt. Ltd). The information, analysis and

estimates contained herein are based on Nirmal Bang Research assessment and have been obtained from sources believed

to be reliable. This document is meant for the use of the intended recipient only. This document, at best, represents Nirmal

Bang Research opinion and is meant for general information only Nirmal Bang Securities Pvt Ltd, its directors, officers or

employees shall not in any way be responsible for the contents stated herein. Nirmal Bang Research expressly disclaims

any and all liabilities that may arise from information, errors or omissions in this connection. This document is not to be

considered as an offer to sell or a solicitation to buy any securities. Nirmal Bang Research, its affiliates and their employees

may from time to time hold positions in securities referred to herein.

Address: Nirmal Bang Securities Pvt. Ltd., B2, 301 / 302, 3rd Floor, Marathon Innova, Opp. Peninsula Corporate Park,

Ganpatrao Kadam Marg, Lower Parel (W), Mumbai - 400 013, India.

29