Page 28 - Bullion World Volume 4 Issue 4 April 2024

P. 28

Bullion World | Volume 4 | Issue 4 | April 2024

Comex silver prices are about to rise further and Although China's contribution to the acquisition of white

silver's returns have the potential to outpace those metals is still low, the country is using more silver as its

of gold. Given the prevailing conditions, silver ought gold stockpiles rise. In the upcoming months, China's

to have surged by now. Silver's supply and demand continued acquisition of silver for its many purposes will

characteristics show that the metal's price is currently contribute to the metal's exponential price increase.

underperforming.

Because the industrial sector and the bars and coin

Over the past two years, there has been a shortage of segments are expected to generate the majority of

more than 1.2 billion ounces in the silver market. The market demand, silver's demand suggests that the

Silver Institute estimates that the shortage in silver was jewelry and silverware sector may experience lower

over 1.24 billion ounces in 2022 and that it will only demand in the upcoming months compared to the

slightly decrease to 1.67 billion ounces in 2023. But demand numbers observed previously. Nonetheless, the

given the ongoing increase in industrial demand and the demand for silver investments, particularly from ETFs,

growing use of silver in solar and green technologies, might stay weak. However, if this ETF's demand for silver

we think the shortfall in 2023 will exceed the projections increases, the price of silver will continue to rise.

made by the Silver Institutes.

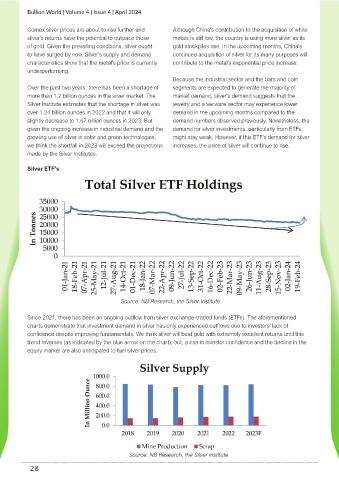

Silver ETF’s

Source: NB Research, the Silver Institute

Since 2021, there has been an ongoing outflow from silver exchange-traded funds (ETFs). The aforementioned

charts demonstrate that investment demand in silver has only experienced outflows due to investors' lack of

confidence despite improving fundamentals. We think silver will beat gold with extremely excellent returns until this

trend reverses (as indicated by the blue arrow on the chart); but, a rise in investor confidence and the decline in the

equity market are also anticipated to fuel silver prices.

Source: NB Research, the Silver Institute

28