Page 28 - Bullion World Volume 5 Issue 1 January 2025

P. 28

Bullion World | Volume 5 | Issue 01 | January 2025

Physical kilobar premiums in Asia trended downwards acquisitions in November as prices retreated below

for most of 2024 as gold prices embarked on a bullish $2,600/oz.

rally in March, achieving 40 new all-time highs and

increasing approximately 30% YTD. The record-breaking A $616/oz rise in average monthly gold prices over

streak was driven by a combination of factors, including the year dampened demand for newly minted kilobars,

lower interest rates and expectations of further rate contributing to steep declines in ask premiums from

cuts, geopolitical tensions in Ukraine and Middle East, March to October. Over this 8-month period, ask

and robust central bank purchases, particularly from premiums fell US$0.90/oz (-45.6%) in Singapore,

China and India. The customary seasonal dip in gold US$1.47/oz (-56.9%) in Hong Kong and US$0.87/oz

consumption in April was compounded by elevated gold (-43.9%) in Bangkok, underscoring the widespread

prices, softening demand and driving premiums lower. impact of price sensitivity across key Asian markets. As

gold prices pulled back in November, there was renewed

In response, the People’s Bank of China (PBoC) buying interest in Asian markets, driving a significant

paused gold purchases for its reserves in April after recovery in premiums and reversing much of the year’s

18 consecutive months of buying, only resuming declines.

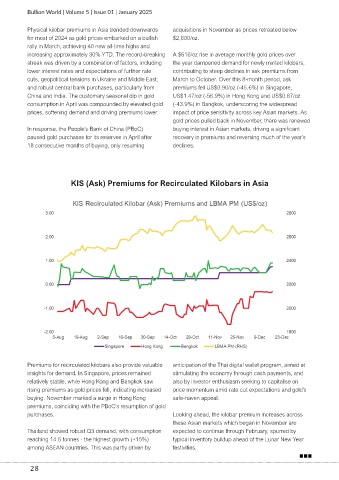

KIS (Ask) Premiums for Recirculated Kilobars in Asia

Premiums for recirculated kilobars also provide valuable anticipation of the Thai digital wallet program, aimed at

insights for demand. In Singapore, prices remained stimulating the economy through cash payments, and

relatively stable, while Hong Kong and Bangkok saw also by investor enthusiasm seeking to capitalise on

rising premiums as gold prices fell, indicating increased price momentum amid rate cut expectations and gold’s

buying. November marked a surge in Hong Kong safe-haven appeal.

premiums, coinciding with the PBoC's resumption of gold

purchases. Looking ahead, the kilobar premium increases across

these Asian markets which began in November are

Thailand showed robust Q3 demand, with consumption expected to continue through February, spurred by

reaching 14.5 tonnes - the highest growth (+15%) typical inventory buildup ahead of the Lunar New Year

among ASEAN countries. This was partly driven by festivities.

28