Page 24 - Bullion World Volume 5 Issue 1 January 2025

P. 24

Bullion World | Volume 5 | Issue 01 | January 2025

B ullion W orld | V olume 5 | I ssue 01 | J anuary 2025

Astro-Technical

Outlook on Gold

and Silver for 2025

Mr Achal Abhishek

AGM & Branch Head, Bullion Branch, State Bank of India

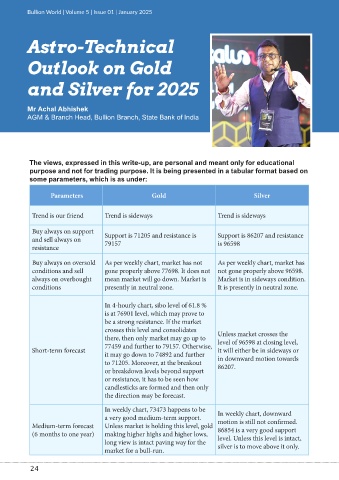

The views, expressed in this write-up, are personal and meant only for educational

purpose and not for trading purpose. It is being presented in a tabular format based on

some parameters, which is as under:

Parameters Gold Silver

Trend is our friend Trend is sideways Trend is sideways

Buy always on support Support is 71205 and resistance is Support is 86207 and resistance

and sell always on 79157 is 96598

resistance

Buy always on oversold As per weekly chart, market has not As per weekly chart, market has

conditions and sell gone properly above 77698. It does not not gone properly above 96598.

always on overbought mean market will go down. Market is Market is in sideways condition.

conditions presently in neutral zone. It is presently in neutral zone.

In 4-hourly chart, sibo level of 61.8 %

is at 76901 level, which may prove to

be a strong resistance. If the market

crosses this level and consolidates

there, then only market may go up to Unless market crosses the

level of 96598 at closing level,

77459 and further to 79157. Otherwise,

Short-term forecast it will either be in sideways or

it may go down to 74892 and further in downward motion towards

to 71205. Moreover, at the breakout 86207.

or breakdown levels beyond support

or resistance, it has to be seen how

candlesticks are formed and then only

the direction may be forecast.

In weekly chart, 73473 happens to be In weekly chart, downward

a very good medium-term support.

Medium-term forecast Unless market is holding this level, gold motion is still not confirmed.

86854 is a very good support

(6 months to one year) making higher highs and higher lows, level. Unless this level is intact,

long view is intact paving way for the silver is to move above it only.

market for a bull-run.

24