Page 26 - Bullion World Volume 5 Issue 1 January 2025

P. 26

Bullion World | Volume 5 | Issue 01 | January 2025

B ullion W orld | V olume 5 | I ssue 01 | J anuary 2025

"Kallanish Index Services:

Delivering Daily Gold Insights Across Asia"

Introduction

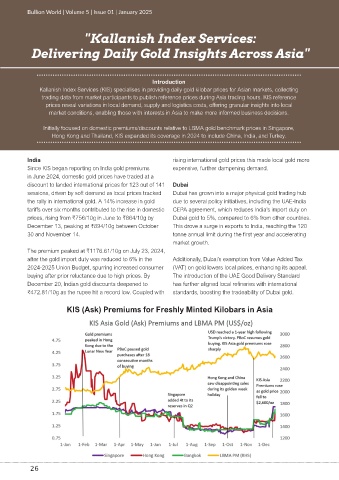

Kallanish Index Services (KIS) specialises in providing daily gold kilobar prices for Asian markets, collecting

trading data from market participants to publish reference prices during Asia trading hours. KIS reference

prices reveal variations in local demand, supply and logistics costs, offering granular insights into local

market conditions, enabling those with interests in Asia to make more informed business decisions.

Initially focused on domestic premiums/discounts relative to LBMA gold benchmark prices in Singapore,

Hong Kong and Thailand, KIS expanded its coverage in 2024 to include China, India, and Turkey.

India rising international gold prices this made local gold more

Since KIS began reporting on India gold premiums expensive, further dampening demand.

in June 2024, domestic gold prices have traded at a

discount to landed international prices for 123 out of 141 Dubai

sessions, driven by soft demand as local prices tracked Dubai has grown into a major physical gold trading hub

the rally in international gold. A 14% increase in gold due to several policy initiatives, including the UAE-India

tariffs over six months contributed to the rise in domestic CEPA agreement, which reduces India’s import duty on

prices, rising from ₹756/10g in June to ₹864/10g by Dubai gold to 5%, compared to 6% from other countries.

December 13, peaking at ₹894/10g between October This drove a surge in exports to India, reaching the 120

30 and November 14. tonne annual limit during the first year and accelerating

market growth.

The premium peaked at ₹1176.61/10g on July 23, 2024,

after the gold import duty was reduced to 6% in the Additionally, Dubai’s exemption from Value Added Tax

2024-2025 Union Budget, spurring increased consumer (VAT) on gold lowers local prices, enhancing its appeal.

buying after prior reluctance due to high prices. By The introduction of the UAE Good Delivery Standard

December 20, Indian gold discounts deepened to has further aligned local refineries with international

₹472.81/10g as the rupee hit a record low. Coupled with standards, boosting the tradeability of Dubai gold.

KIS (Ask) Premiums for Freshly Minted Kilobars in Asia

26