Page 12 - Bullion World Volume 4 Issue 1 January 2024

P. 12

Bullion World | Volume 4 | Issue 1 | January 2024

1. RBI's Moderate Gold Purchases: 2. Increased Gold Imports:

• RBI gold reserves reached 803.6 tonnes by end- • High prices and soft demand lead to varying gold

November. import volumes in 2023.

• In 2023, RBI bought an average of 1.5 tonnes/ • Monthly imports fluctuated from 11 to 121 tonnes,

month, totalling 16.2 tonnes. with Q1 at a decadal low.

• Cumulative Jan-Oct 2023 imports were 630 tonnes,

a 2% YoY increase.

2024 Price Outlook

Gold had an outstanding performance in 2023, rising around 12% from $1820/oz to $2060s in the international markets.

While the domestic performance has been better, with the prices rising 15% from Rs 55000/10g to almost Rs 63000/10g.

Gold has given positive returns 80% of the time in the last 20 years with an average CAGR of 12%. While Silver has given

positive returns 75% of the time in the last 20 years.

Gold prices attempted to clear the resistance around $2080 (~ Rs 63400/10g) for a single day, but did not sustain. A lot

of positive news, follow-through buying and a sense of fear would be required for the prices to surpass that level. Once it

does, though, the possibilities are that the Bull Run won’t end until $2300 (~ Rs 70000/10g). While on the downside, gold

prices have formed a base around $1900 (~ Rs 58000 p/10g), which would act as the floor of this Bull Run.

Talking about Silver, global economic movements, currency fluctuations, and geopolitical happenings all have an impact

on silver market dynamics. From the technical perspective too, I remain optimistic, predicting a 20% higher target of $30/

oz (~ Rs 90000/kg) by the end of the year 2024 in Silver. In the short term, we can see prices inching towards $27/oz (~ Rs

82000/kg) and the downside is restricted to $23/oz (~ Rs 71500/kg)

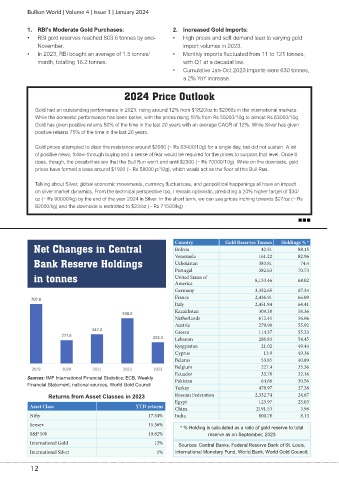

Net Changes in Central Country Gold Reserves Tonnes Holdings % *

42.51

Bolivia

88.15

Venezuela 161.22 82.96

Bank Reserve Holdings Uzbekistan 383.81 74.4

Portugal 382.63 70.73

in tonnes United States of 8,133.46 68.02

America

Germany 3,352.65 67.34

France 2,436.91 66.09

Italy 2,451.84 64.41

Kazakhstan 309.38 58.36

Netherlands 612.45 56.06

Austria 279.99 55.92

Greece 114.37 55.23

Lebanon 286.83 54.45

Kyrgyzstan 21.02 49.44

Cyprus 13.9 49.36

Belarus 53.85 40.89

Belgium 227.4 35.36

Ecuador 33.78 32.16

Sources: IMF International Financial Statistics; ECB, Weekly Pakistan 64.66 30.56

Financial Statement, national sources, World Gold Council

Turkey 478.97 27.38

Returns from Asset Classes in 2023 Russian Federation 2,332.74 24.67

Egypt 125.97 23.03

Asset Class YTD returns China 2191.53 3.98

Nifty 17.54% India 800.78 8.13

Sensex 15.36%

* % Holding is calculated as a ratio of gold reserve to total

S&P 500 19.82% reserve as on September, 2023

International Gold 12% Sources: Central Banks, Federal Reserve Bank of St. Louis,

International Silver 1% International Monetary Fund, World Bank, World Gold Council;

12