Page 11 - Bullion World Volume 4 Issue 1 January 2024

P. 11

Bullion World | Volume 4 | Issue 1 | January 2024

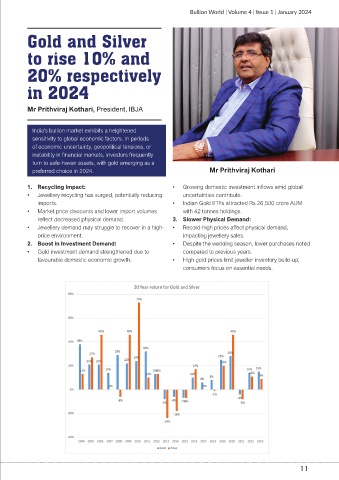

Gold and Silver

to rise 10% and

20% respectively

in 2024

Mr Prithviraj Kothari, President, IBJA

India's bullion market exhibits a heightened

sensitivity to global economic factors. In periods

of economic uncertainty, geopolitical tensions, or

instability in financial markets, investors frequently

turn to safe-haven assets, with gold emerging as a

preferred choice in 2024. Mr Prithviraj Kothari

1. Recycling Impact: • Growing domestic investment inflows amid global

• Jewellery recycling has surged, potentially reducing uncertainties contribute.

imports. • Indian Gold ETFs attracted Rs 26,500 crore AUM

• Market price discounts and lower import volumes with 42 tonnes holdings.

reflect decreased physical demand. 3. Slower Physical Demand:

• Jewellery demand may struggle to recover in a high- • Record-high prices affect physical demand,

price environment. impacting jewellery sales.

2. Boost in Investment Demand: • Despite the wedding season, lower purchases noted

• Gold investment demand strengthened due to compared to previous years.

favourable domestic economic growth. • High gold prices limit jeweller inventory build-up;

consumers focus on essential needs.

11