Page 14 - Bullion World Volume 02 Issue 08 September 2022

P. 14

Bullion World | Volume 2 | Issue 09 | September 2022

Excerpts of Memorandum submitted to

Govt. of India by AGRM on Reviving GMS

To people are importing gold“

Smt. Nirmala Sitharaman

Hon Minister for Finance However the ground realty is that

Govt of india the consumption and demand for

gold in india is highly inelastic,

Sub: suggestions to reduce annual vis a vis import duty, gold price

import of 750 tonnes of gold and CAD or supply side constraints – the

country has been importing

Ref: our earlier letters on around 700-800 tonnes of gold for

policy tweekings to make GMS domestic consumption for the past

operational, to collect domestic gold 2 decades and this steady demand

deposits and affinity for gold jewellery is

arising from religious, cultural,

Respected madam social and economical factors,

We appreciate and respect your irrespective of gold prices, which

Mr James Jose concern in the words -“India does fluctuate 10% intra year.

Past Secretary, Association of not produce much gold. In fact the

Gold Refineries and Mints production is almost zilch, so you An increase in import duty per se,

are importing by paying foreign need not bring down the demand

exchange. So, you want to see for gold, as illustrated from past

whether you can at least try to experience

discourage the extend to which

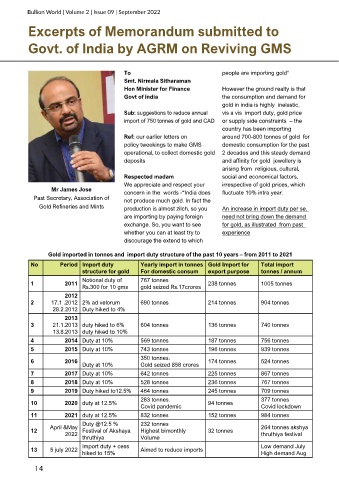

Gold imported in tonnes and import duty structure of the past 10 years – from 2011 to 2021

No Period Import duty Yearly import in tonnes Gold Import for Total import

structure for gold For domestic consum export purpose tonnes / annum

Notional duty of 767 tonnes

1 2011 238 tonnes 1005 tonnes

Rs.300 for 10 gms gold seized Rs.17crores

2012

2 17.1 .2012 2% ad velorum 690 tonnes 214 tonnes 904 tonnes

28.2.2012 Duty hiked to 4%

2013

3 21.1.2013 duty hiked to 6% 604 tonnes 136 tonnes 740 tonnes

13.8.2013 duty hiked to 10%

4 2014 Duty at 10% 569 tonnes 187 tonnes 756 tonnes

5 2015 Duty at 10% 743 tonnes 196 tonnes 939 tonnes

350 tonnes.

6 2016 174 tonnes 524 tonnes

Duty at 10% Gold seized 858 crores

7 2017 Duty at 10% 642 tonnes 225 tonnes 867 tonnes

8 2018 Duty at 10% 528 tonnes 236 tonnes 767 tonnes

9 2019 Duty hiked to12.5% 464 tonnes 245 tonnes 709 tonnes

283 tonnes. 377 tonnes

10 2020 duty at 12.5% 94 tonnes

Covid pandemic Covid lockdown

11 2021 duty at 12.5% 832 tonnes 152 tonnes 984 tonnes

Duty @12.5 % 232 tonnes

April &May 264 tonnes akshya

12 Festival of Akshaya Highest bimonthly 32 tonnes

2022 thruthiya festival

thruthiya Volume

Import duty + cess Low demand July

13 5 july 2022 Aimed to reduce imports

hiked to 15% High demand Aug

14