Page 27 - Bullion World Volume 02 Issue 02 June 2022_Neat

P. 27

Bullion World | Volume 2 | Issue 02 | June 2022

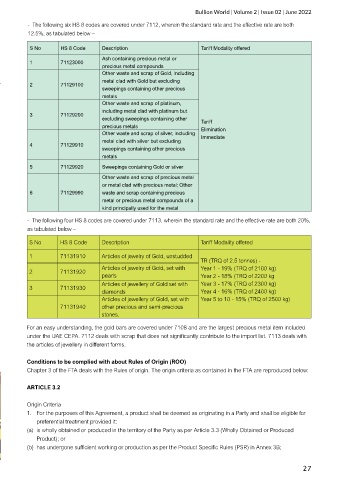

- The following six HS 8 codes are covered under 7112, wherein the standard rate and the effective rate are both

12.5%, as tabulated below –

S No HS 8 Code Description Tariff Modality offered

Ash containing precious metal or

1 71123000

precious metal compounds

Other waste and scrap of Gold, including

metal clad with Gold but excluding

2 71129100

sweepings containing other precious

metals

Other waste and scrap of platinum,

including metal clad with platinum but

3 71129200

excluding sweepings containing other Tariff

precious metals Elimination

Other waste and scrap of silver, including Immediate

metal clad with silver but excluding

4 71129910

sweepings containing other precious

metals

5 71129920 Sweepings containing Gold or silver

Other waste and scrap of precious metal

or metal clad with precious metal; Other

6 71129990 waste and scrap containing precious

metal or precious metal compounds of a

kind principally used for the metal

- The following four HS 8 codes are covered under 7113, wherein the standard rate and the effective rate are both 20%,

as tabulated below –

S No HS 8 Code Description Tariff Modality offered

1 71131910 Articles of jewelry of Gold, unstudded

TR (TRQ of 2.5 tonnes) -

Articles of jewelry of Gold, set with Year 1 - 19% (TRQ of 2100 kg)

2 71131920

pearls Year 2 - 18% (TRQ of 2200 kg

Articles of jewellery of Gold set with Year 3 - 17% (TRQ of 2300 kg)

3 71131930

diamonds Year 4 - 16% (TRQ of 2400 kg)

Articles of jewellery of Gold, set with Year 5 to 10 - 15% (TRQ of 2500 kg)

71131940 other precious and semi-precious

stones.

For an easy understanding, the gold bars are covered under 7108 and are the largest precious metal item included

under the UAE CEPA. 7112 deals with scrap that does not significantly contribute to the import list. 7113 deals with

the articles of jewellery in different forms.

Conditions to be complied with about Rules of Origin (ROO)

Chapter 3 of the FTA deals with the Rules of origin. The origin criteria as contained in the FTA are reproduced below:

ARTICLE 3.2

Origin Criteria

1. For the purposes of this Agreement, a product shall be deemed as originating in a Party and shall be eligible for

preferential treatment provided it:

(a) is wholly obtained or produced in the territory of the Party as per Article 3.3 (Wholly Obtained or Produced

Product); or

(b) has undergone sufficient working or production as per the Product Specific Rules (PSR) in Annex 3B;

27