-

Are high gold prices impacting Chinese demand? Bullion imports through Hong Kong cut in half last month

Tue Mar 26 2024

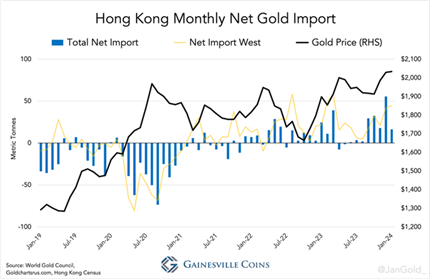

Sky-high gold prices may finally be impacting demand in the world’s second-largest economy and number-one bullion market, as the latest data showed China’s net gold imports from Hong Kong fell 48% last month.

Net imports from the Special Administrative Region were 39.826 metric tons in February, data from the Hong Kong Census and Statistics Department showed, far lower than the 76.248 tons imported in January and the lowest level since November 2023.

“It sounds as if international bank import quotas have been delayed as the government defended the currency and that is probably the key issue here,” StoneX analyst Rhona O’Connell told Reuters, adding that the country’s declining property market is spurring citizens to invest in gold. The People’s Bank of China (PBoC) sets the quotas that determine the amount of gold that commercial banks can import.

The low February numbers could also have been impacted by the Lunar New Year holidays, which shuttered markets and stopped most business activities between Feb. 10-17. The country saw very high demand for the yellow metal in the run-up to the New Year, with Chinese sellers fetching premiums as high as $55 per ounce above global spot prices.

According to a recently published analysis from Gainesville Coins’ Jan Nieuwenhuijs, Hong Kong’s gold flows are one of the best illustrations of the massive market shift towards China since the Russian invasion of Ukraine, as a large portion of the country’s gold trade runs through it.

Nieuwenhuijs wrote that Hong Kong saw a strong increase in gold imports during this period even as prices rose, which he said could be due to “the PBoC buying gold in Hong Kong (monetizing it in Hong Kong and then repatriating it off the radar), affluent Asian citizens buying and storing gold there, or bullion banks storing gold there in anticipation of strong demand in the East.

He pointed out that when gold prices went up in the past, Hong Kong would become a net exporter and the West would be its biggest customer, as happened in 2020. “But since 2022, the West is a supplier while the gold price rises,” he said. “Likely, Hong Kong has also become one of the driving forces of the gold price.”

Source: https://www.kitco.com/