Page 10 - Bullion World Volume 4 Issue 5 May 2024

P. 10

Bullion World | Volume 4 | Issue 5 | May 2024

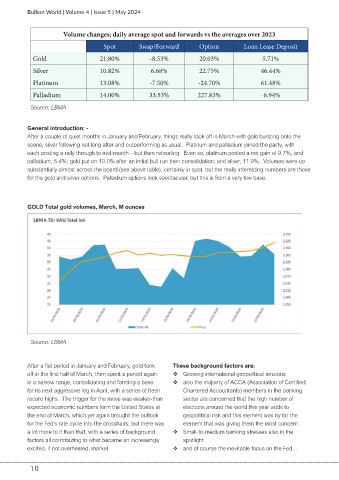

Volume changes; daily average spot and forwards vs the averages over 2023

Spot Swap/Forward Option Loan Lease Deposit

Gold 21.80% -8.53% 20.03% 5.71%

Silver 10.82% 6.68% 22.75% 46.44%

Platinum 13.08% -7.50% -24.70% 61.48%

Palladium 14.00% 33.53% 227.83% -6.94%

Source: LBMA

General introduction: -

After a couple of quiet months in January and February, things really took off in March with gold bursting onto the

scene, silver following not long after and outperforming as usual. Platinum and palladium joined the party, with

each posting a rally through to mid-month – but then retreating. Even so, platinum posted a net gain of 9.7%, and

palladium, 5.4%; gold put on 10.0% after an initial bull run then consolidation; and silver, 11.9%. Volumes were up

substantially almost across the board (see above table), certainly in spot, but the really interesting numbers are those

for the gold and silver options. Palladium options look spectacular, but this is from a very low base.

GOLD Total gold volumes, March, M ounces

Source: LBMA

After a flat period in January and February, gold took These background factors are:

off in the first half of March, then spent a period again Growing international geopolitical tensions

in a narrow range, consolidating and forming a base also the majority of ACCA (Association of Certified

for its next aggressive leg in April, with a series of fresh Chartered Accountants) members in the banking

record highs. The trigger for the move was weaker-than sector are concerned that the high number of

expected economic numbers form the United States at elections around the world this year adds to

the end of March, which yet again brought the outlook geopolitical risk and this element was by far the

for the Fed’s rate cycle into the crosshairs, but there was element that was giving them the most concern

a lot more to it than that, with a series of background Small-to-medium banking stresses also in the

factors all contributing to what became an increasingly spotlight

excited, if not overheated, market. and of course the inevitable focus on the Fed…

10