Page 14 - Bullion World Volume 3 Issue 1 2023

P. 14

Bullion World | Volume 3 | Issue 1 | January 2023

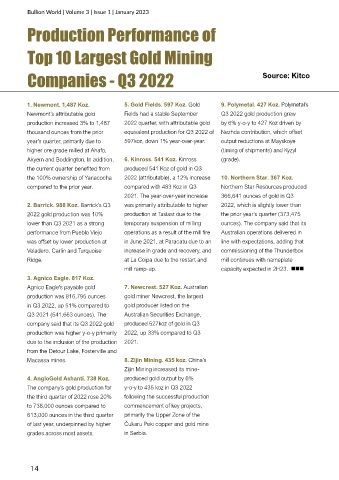

Production Performance of

Top 10 Largest Gold Mining

Companies - Q3 2022 Source: Kitco

1. Newmont. 1,487 Koz. 5. Gold Fields. 597 Koz. Gold 9. Polymetal. 427 Koz. Polymetal’s

Newmont’s attributable gold Fields had a stable September Q3 2022 gold production grew

production increased 3% to 1,487 2022 quarter, with attributable gold by 6% y-o-y to 427 Koz driven by

thousand ounces from the prior equivalent production for Q3 2022 of Nezhda contribution, which offset

year’s quarter, primarily due to 597koz, down 1% year-over-year. output reductions at Mayskoye

higher ore grade milled at Ahafo, (timing of shipments) and Kyzyl

Akyem and Boddington. In addition, 6. Kinross. 541 Koz. Kinross (grade).

the current quarter benefited from produced 541 Koz of gold in Q3

the 100% ownership of Yanacocha 2022 (attributable), a 12% increase 10. Northern Star. 367 Koz.

compared to the prior year. compared with 483 Koz in Q3 Northern Star Resources produced

2021. The year-over-year increase 366,641 ounces of gold in Q3

2. Barrick. 988 Koz. Barrick’s Q3 was primarily attributable to higher 2022, which is slightly lower than

2022 gold production was 10% production at Tasiast due to the the prior year’s quarter (373,475

lower than Q3 2021 as a strong temporary suspension of milling ounces). The company said that its

performance from Pueblo Viejo operations as a result of the mill fire Australian operations delivered in

was offset by lower production at in June 2021, at Paracatu due to an line with expectations, adding that

Veladero, Carlin and Turquoise increase in grade and recovery, and commissioning of the Thunderbox

Ridge. at La Coipa due to the restart and mill continues with nameplate

mill ramp-up. capacity expected in 2H23.

3. Agnico Eagle. 817 Koz.

Agnico Eagle's payable gold 7. Newcrest. 527 Koz. Australian

production was 816,795 ounces gold miner Newcrest, the largest

in Q3 2022, up 51% compared to gold producer listed on the

Q3 2021 (541,663 ounces). The Australian Securities Exchange,

company said that its Q3 2022 gold produced 527koz of gold in Q3

production was higher y-o-y primarily 2022, up 33% compared to Q3

due to the inclusion of the production 2021.

from the Detour Lake, Fosterville and

Macassa mines. 8. Zijin Mining. 435 koz. China’s

Zijin Mining increased its mine-

4. AngloGold Ashanti. 738 Koz. produced gold output by 6%

The company’s gold production for y-o-y to 435 koz in Q3 2022

the third quarter of 2022 rose 20% following the successful production

to 738,000 ounces compared to commencement of key projects,

613,000 ounces in the third quarter primarily the Upper Zone of the

of last year, underpinned by higher Čukaru Peki copper and gold mine

grades across most assets. in Serbia.

14