Page 30 - Bullion World Volume 3 Issue 2 February 2023

P. 30

Bullion World | Volume 3 | Issue 2 | February 2023

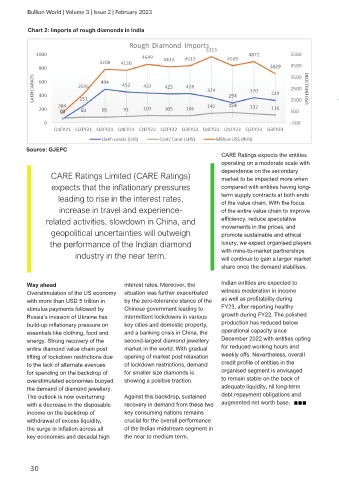

Chart 2: Imports of rough diamonds in India

Source: GJEPC

CARE Ratings expects the entities

operating on a moderate scale with

dependence on the secondary

CARE Ratings Limited (CARE Ratings) market to be impacted more when

expects that the inflationary pressures compared with entities having long-

leading to rise in the interest rates, term supply contracts at both ends

of the value chain. With the focus

increase in travel and experience- of the entire value chain to improve

related activities, slowdown in China, and efficiency, reduce speculative

movements in the prices, and

geopolitical uncertainties will outweigh promote sustainable and ethical

the performance of the Indian diamond luxury, we expect organised players

with mine-to-market partnerships

industry in the near term. will continue to gain a larger market

share once the demand stabilises.

Way ahead interest rates. Moreover, the Indian entities are expected to

Overstimulation of the US economy situation was further exacerbated witness moderation in income

with more than USD 5 trillion in by the zero-tolerance stance of the as well as profitability during

stimulus payments followed by Chinese government leading to FY23, after reporting healthy

Russia’s invasion of Ukraine has intermittent lockdowns in various growth during FY22. The polished

build-up inflationary pressure on key cities and domestic property, production has reduced below

essentials like clothing, food and and a banking crisis in China, the operational capacity since

energy. Strong recovery of the second-largest diamond jewellery December 2022 with entities opting

entire diamond value chain post market in the world. With gradual for reduced working hours and

lifting of lockdown restrictions due opening of market post relaxation weekly offs. Nevertheless, overall

to the lack of alternate avenues of lockdown restrictions, demand credit profile of entities in the

for spending on the backdrop of for smaller size diamonds is organised segment is envisaged

overstimulated economies buoyed showing a positive traction. to remain stable on the back of

the demand of diamond jewellery. adequate liquidity, nil long-term

The outlook is now overturning Against this backdrop, sustained debt repayment obligations and

with a decrease in the disposable recovery in demand from these two augmented net worth base.

income on the backdrop of key consuming nations remains

withdrawal of excess liquidity, crucial for the overall performance

the surge in inflation across all of the Indian midstream segment in

key economies and decadal high the near to medium term.

30