Page 29 - Bullion World Volume 3 Issue 2 February 2023

P. 29

Bullion World | Volume 3 | Issue 2 | February 2023

Disruption in supply from Alrosa, Rough diamond prices impact the increase in the procurement

the largest rough diamond miner, pricing parity price per carat during H1FY23 to a

has helped De Beers clock 18% Rough diamond imports increased certain extent reflects the absence

y-o-y growth at USD 5.67 billion with the resumption of operations of Alrosa, which is estimated to

in CY22 (CY refers to the period post subsiding the effects of have the largest share in smaller-

January 01 to December 31) in COVID-19 and reflected an size diamonds.

rough diamond sales, primarily increasing trend in value terms

backed by increase in the prices. till Q4FY22. However, it was

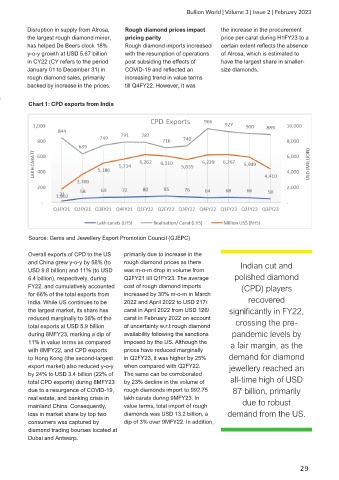

Chart 1: CPD exports from India

Source: Gems and Jewellery Export Promotion Council (GJEPC)

Overall exports of CPD to the US primarily due to increase in the

and China grew y-o-y by 58% (to rough diamond prices as there Indian cut and

USD 9.8 billion) and 11% (to USD was m-o-m drop in volume from

6.4 billion), respectively, during Q2FY21 till Q1FY23. The average polished diamond

FY22, and cumulatively accounted cost of rough diamond imports (CPD) players

for 66% of the total exports from increased by 30% m-o-m in March

India. While US continues to be 2022 and April 2022 to USD 217/ recovered

the largest market, its share has carat in April 2022 from USD 126/ significantly in FY22,

reduced marginally to 38% of the carat in February 2022 on account

total exports at USD 5.9 billion of uncertainty w.r.t rough diamond crossing the pre-

during 8MFY23, marking a dip of availability following the sanctions pandemic levels by

11% in value terms as compared imposed by the US. Although the a fair margin, as the

with 8MFY22, and CPD exports prices have reduced marginally

to Hong Kong (the second-largest in Q2FY23, it was higher by 25% demand for diamond

export market) also reduced y-o-y when compared with Q2FY22. jewellery reached an

by 24% to USD 3.4 billion (22% of The same can be corroborated

total CPD exports) during 8MFY23 by 23% decline in the volume of all-time high of USD

due to a resurgence of COVID-19, rough diamonds import to 992.75 87 billion, primarily

real estate, and banking crisis in lakh carats during 9MFY23. In

mainland China. Consequently, value terms, total import of rough due to robust

loss in market share by top two diamonds was USD 13.2 billion, a demand from the US.

consumers was captured by dip of 3% over 9MFY22. In addition,

diamond trading bourses located at

Dubai and Antwerp.

29