Page 17 - Bullion World Volume 3 Issue 2 February 2023

P. 17

Bullion World | Volume 3 | Issue 2 | February 2023

MCX bullion contracts witness the participation of bullion importers, traders

and jewelers for hedging, as well as delivery. This is seeing a broader MCX bullion

increase by way of small and medium jewellers from across cities and towns contracts witness

of India becoming part of the Exchange eco-system. the participation of

bullion importers,

The turnover of bullion futures contract during CY-2022 was about 27 lakh traders and

crore. The turnover of bullion options contract in the CY 2022 of 4.15 lakh jewelers for

crore had seen significant increase of around 200% as compared to last hedging, as well

year turnover of 2 lakh crore.

as delivery. This is

seeing a broader

After receiving overwhelming response for Gold 1kg and Silver 30kg

options contract, we received requests from jewelers to introduce smaller increase by way of

denomination options. MCX launched Silver Mini Options contract with small and medium

Silver Mini Futures as underlying on July 19, 2021 and Gold Mini Options jewellers from

contract with Gold Mini (100 Grams) Futures as the underlying on April 25, across cities and

2022. Characterized by expiries in every month, smaller denominations, and towns of India

therefore, carrying lower premiums, which would enable small and medium- becoming part of

sized jewelers to hedge their bullion price risk. the Exchange eco-

system.

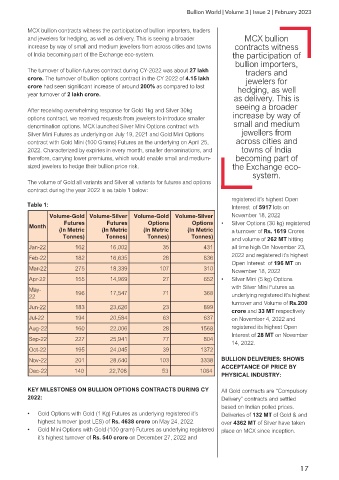

The volume of Gold all variants and Silver all variants for futures and options

contract during the year 2022 is as table 1 below:

registered it’s highest Open

Table 1:

Interest of 5917 lots on

Volume-Gold Volume-Silver Volume-Gold Volume-Silver November 18, 2022

Futures Futures Options Options • Silver Options (30 kg) registered

Month

(In Metric (In Metric (In Metric (In Metric a turnover of Rs. 1619 Crores

Tonnes) Tonnes) Tonnes) Tonnes)

and volume of 262 MT hitting

Jan-22 162 16,002 35 431 all time high On November 23,

Feb-22 182 16,635 28 836 2022 and registered it’s highest

Open Interest of 196 MT on

Mar-22 275 18,339 107 310

November 18, 2022

Apr-22 155 14,969 27 652 • Silver Mini (5 kg) Options

May- 196 17,547 71 368 with Silver Mini Futures as

22 underlying registered it’s highest

turnover and Volume of Rs.200

Jun-22 183 23,626 23 899

crore and 33 MT respectively

Jul-22 194 20,584 63 637 on November 4, 2022 and

Aug-22 160 22,006 28 1568 registered its highest Open

Interest of 28 MT on November

Sep-22 227 25,941 77 804

14, 2022.

Oct-22 195 24,045 39 1372

Nov-22 201 28,640 103 3338 BULLION DELIVERIES: SHOWS

ACCEPTANCE OF PRICE BY

Dec-22 140 22,708 53 1064

PHYSICAL INDUSTRY:

KEY MILESTONES ON BULLION OPTIONS CONTRACTS DURING CY All Gold contracts are “Compulsory

2022: Delivery” contracts and settled

based on Indian polled prices.

• Gold Options with Gold (1 Kg) Futures as underlying registered it’s Deliveries of 132 MT of Gold & and

highest turnover (post LES) of Rs. 4638 crore on May 24, 2022. over 4362 MT of Silver have taken

• Gold Mini Options with Gold (100 gram) Futures as underlying registered place on MCX since inception.

it’s highest turnover of Rs. 540 crore on December 27, 2022 and

17