Page 14 - Bullion World Volume 3 Issue 2 February 2023

P. 14

Bullion World | Volume 3 | Issue 2 | February 2023

Price Risk Management Via

MCX Bullion Derivatives Contract

Mr Shivanshu Mehta, Head - Bullion, MCX

Characterised by expiries every month and smaller denominations,

therefore, carrying lower premiums, Gold and Silver mini contracts would

enable small and medium-sized jewelers to hedge their bullion price risk.

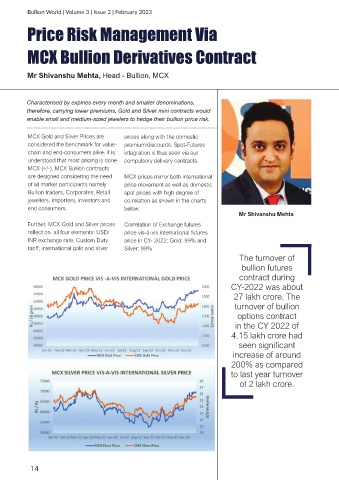

MCX Gold and Silver Prices are prices along with the domestic

considered the benchmark for value- premium/discounts. Spot-Futures

chain and end-consumers alike. It is integration is thus seen via our

understood that most pricing is done compulsory delivery contracts.

MCX (+/-). MCX Bullion contracts

are designed considering the need MCX prices mirror both international

of all market participants namely price movement as well as domestic

Bullion traders, Corporates, Retail spot prices with high degree of

jewellers, importers, investors and co-relation as shown in the charts

end consumers. below:

Mr Shivanshu Mehta

Further, MCX Gold and Silver prices Correlation of Exchange futures

reflect on all four elements: USD/ price vis-à-vis international futures

INR exchange rate, Custom Duty price in CY- 2022: Gold: 99% and

tariff, international gold and silver Silver: 99%

The turnover of

bullion futures

contract during

CY-2022 was about

27 lakh crore. The

turnover of bullion

options contract

in the CY 2022 of

4.15 lakh crore had

seen significant

increase of around

200% as compared

to last year turnover

of 2 lakh crore.

14