Page 14 - Bullion World Volume 04 Issue 08 August 2023

P. 14

Bullion World | Volume 3 | Issue 8 | August 2023

(see Table 1). This is a rise from achievable. Possible stumbling shipment, which are high at 48 hours

an initial target of 140 tonnes – and blocks may come with regulatory as against regular shipments of less

$8 bn – in the CEPA’s second year, red tape such as the Import of than 12 hours. Further, the Indian

which is near the current annual Goods at a Concessional Rate of market has remained at a discount

average of gold imports from UAE to Duty or for Specified End Use Rules, through most of the period with zero

India outside the trade agreement. 2022 (IGCRS Rules) and linking it duty-rated supplies due to other

There is however an important with the eligible beneficiaries of the bilateral and multilateral agreements,

distinction. Under the CEPA, concession duty (The Tariff Rate disincentivising the exporter from

India may only import gold bars Quota holders -TRQ). The end-use UAE.

manufactured by a UAE Good rules have made it a requirement

Delivery Refiner. to validate (end-user TRQ holders) Suppliers find it profitable to ship only

usage by authorized importers. where the Indian market is at least

Of course, India and the UAE have a Such barriers left unaddressed will at parity to the London spot price for

trading relationship that is decades only increase costs of supplying gold transacting under CEPA. As a result

old. This should make for a smoother to India under the CEPA, eclipsing total exports under CEPA in the first

implementation of the agreement the benefits. Adding to the costs are year were less than 10 tonnes to India

and the increased gold targets bank guarantees and times to clear against a target of 120 tonnes.

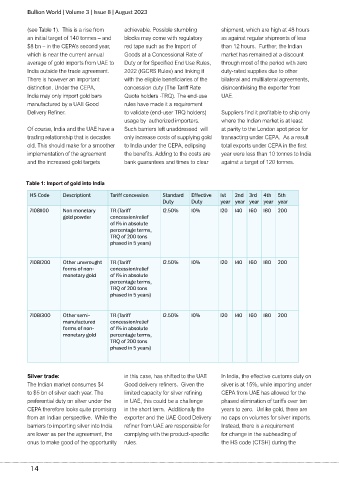

Table 1: Import of gold into India

HS Code Descriptiont Tariff concession Standard Effective 1st 2nd 3rd 4th 5th

Duty Duty year year year year year

71081100 Non monetary TR (Tariff 12.50% 10% 120 140 160 180 200

gold powder concession/relief

of 1% in absolute

percentage terms,

TRQ of 200 tons

phased in 5 years)

71081200 Other unwrought TR (Tariff 12.50% 10% 120 140 160 180 200

forms of non- concession/relief

monetary gold of 1% in absolute

percentage terms,

TRQ of 200 tons

phased in 5 years)

71081300 Other semi- TR (Tariff 12.50% 10% 120 140 160 180 200

manufactured concession/relief

forms of non- of 1% in absolute

monetary gold percentage terms,

TRQ of 200 tons

phased in 5 years)

Silver trade: in this case, has shifted to the UAE In India, the effective customs duty on

The Indian market consumes $4 Good delivery refiners. Given the silver is at 15%, while importing under

to $5 bn of silver each year. The limited capacity for silver refining CEPA from UAE has allowed for the

preferential duty on silver under the in UAE, this could be a challenge phased elimination of tariffs over ten

CEPA therefore looks quite promising in the short term. Additionally the years to zero. Unlike gold, there are

from an Indian perspective. While the exporter and the UAE Good Delivery no caps on volumes for silver imports.

barriers to importing silver into India refiner from UAE are responsible for Instead, there is a requirement

are lower as per the agreement, the complying with the product-specific for change in the subheading of

onus to make good of the opportunity rules. the HS code (CTSH) during the

14