Page 27 - Bullion World Volume 02 Issue 08 September 2022

P. 27

Bullion World | Volume 2 | Issue 09 | September 2022

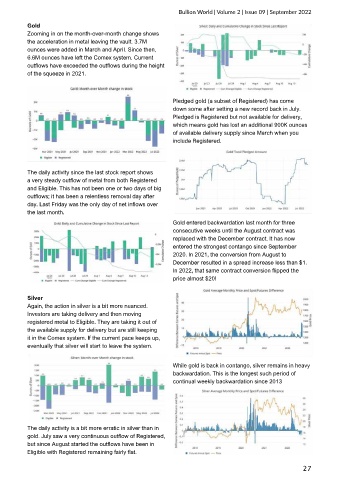

Gold

Zooming in on the month-over-month change shows

the acceleration in metal leaving the vault. 3.7M

ounces were added in March and April. Since then,

6.6M ounces have left the Comex system. Current

outflows have exceeded the outflows during the height

of the squeeze in 2021.

Pledged gold (a subset of Registered) has come

down some after setting a new record back in July.

Pledged is Registered but not available for delivery,

which means gold has lost an additional 900K ounces

of available delivery supply since March when you

include Registered.

The daily activity since the last stock report shows

a very steady outflow of metal from both Registered

and Eligible. This has not been one or two days of big

outflows; it has been a relentless removal day after

day. Last Friday was the only day of net inflows over

the last month.

Gold entered backwardation last month for three

consecutive weeks until the August contract was

replaced with the December contract. It has now

entered the strongest contango since September

2020. In 2021, the conversion from August to

December resulted in a spread increase less than $1.

In 2022, that same contract conversion flipped the

price almost $20!

Silver

Again, the action in silver is a bit more nuanced.

Investors are taking delivery and then moving

registered metal to Eligible. They are taking it out of

the available supply for delivery but are still keeping

it in the Comex system. If the current pace keeps up,

eventually that silver will start to leave the system.

While gold is back in contango, silver remains in heavy

backwardation. This is the longest such period of

continual weekly backwardation since 2013

The daily activity is a bit more erratic in silver than in

gold. July saw a very continuous outflow of Registered,

but since August started the outflows have been in

Eligible with Registered remaining fairly flat.

27