Page 29 - Bullion World Volume 02 Issue 01 May 2022

P. 29

Bullion World | Volume 2 | Issue 01 | May 2022

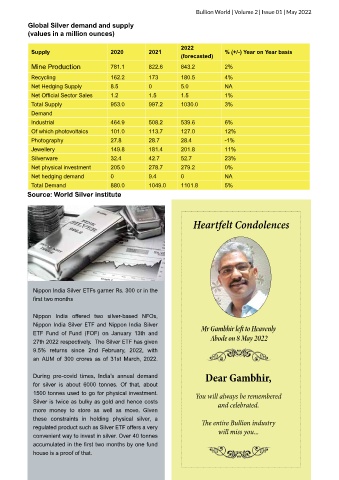

Global Silver demand and supply

(values in a million ounces)

2022

Supply 2020 2021 % (+/-) Year on Year basis

(forecasted)

Mine Production 781.1 822.6 843.2 2%

Recycling 162.2 173 180.5 4%

Net Hedging Supply 8.5 0 5.0 NA

Net Official Sector Sales 1.2 1.5 1.5 1%

Total Supply 953.0 997.2 1030.0 3%

Demand

Industrial 464.9 508.2 539.6 6%

Of which photovoltaics 101.0 113.7 127.0 12%

Photography 27.8 28.7 28.4 -1%

Jewellery 149.8 181.4 201.8 11%

Silverware 32.4 42.7 52.7 23%

Net physical investment 205.0 278.7 279.2 0%

Net hedging demand 0 9.4 0 NA

Total Demand 880.0 1049.0 1101.8 5%

Source: World Silver institute

Heartfelt Condolences

Nippon India Silver ETFs garner Rs. 300 cr in the

first two months

Nippon India offered two silver-based NFOs,

Nippon India Silver ETF and Nippon India Silver Mr Gambhir left to Heavenly

ETF Fund of Fund (FOF) on January 13th and Abode on 8 May 2022

27th 2022 respectively. The Silver ETF has given

9.5% returns since 2nd February, 2022, with

an AUM of 300 crores as of 31st March, 2022.

During pre-covid times, India’s annual demand Dear Gambhir,

for silver is about 6000 tonnes. Of that, about

1500 tonnes used to go for physical investment. You will always be remembered

Silver is twice as bulky as gold and hence costs and celebrated.

more money to store as well as move. Given

these constraints in holding physical silver, a The entire Bullion industry

regulated product such as Silver ETF offers a very will miss you...

convenient way to invest in silver. Over 40 tonnes

accumulated in the first two months by one fund

house is a proof of that.

29