Page 31 - Bullion World Volume 4 Issue 2 February 2024

P. 31

Bullion World | Volume 4 | Issue 2 | February 2024

Domestic jewellery consumption growth

in value terms revised upward to 10-12%

YoY in FY2024 due to rise in gold prices

Authors:

Mr Sujoy Saha, Vice President, ICRA Limited

Mr Raunak Modi, Senior Analyst, ICRA Limited

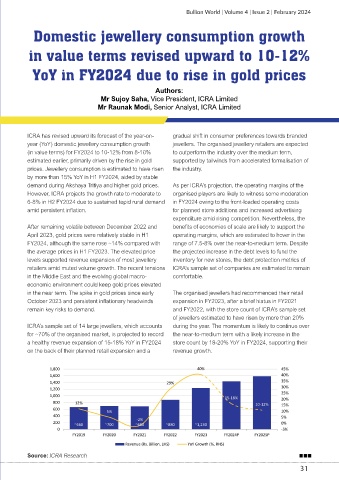

ICRA has revised upward its forecast of the year-on- gradual shift in consumer preferences towards branded

year (YoY) domestic jewellery consumption growth jewellers. The organised jewellery retailers are expected

(in value terms) for FY2024 to 10-12% from 8-10% to outperform the industry over the medium term,

estimated earlier, primarily driven by the rise in gold supported by tailwinds from accelerated formalisation of

prices. Jewellery consumption is estimated to have risen the industry.

by more than 15% YoY in H1 FY2024, aided by stable

demand during Akshaya Tritiya and higher gold prices. As per ICRA’s projection, the operating margins of the

However, ICRA projects the growth rate to moderate to organised players are likely to witness some moderation

6-8% in H2 FY2024 due to sustained tepid rural demand in FY2024 owing to the front-loaded operating costs

amid persistent inflation. for planned store additions and increased advertising

expenditure amid rising competition. Nevertheless, the

After remaining volatile between December 2022 and benefits of economies of scale are likely to support the

April 2023, gold prices were relatively stable in H1 operating margins, which are estimated to hover in the

FY2024, although the same rose ~14% compared with range of 7.5-8% over the near-to-medium term. Despite

the average prices in H1 FY2023. The elevated price the projected increase in the debt levels to fund the

levels supported revenue expansion of most jewellery inventory for new stores, the debt protection metrics of

retailers amid muted volume growth. The recent tensions ICRA’s sample set of companies are estimated to remain

in the Middle East and the evolving global macro- comfortable.

economic environment could keep gold prices elevated

in the near term. The spike in gold prices since early The organised jewellers had recommenced their retail

October 2023 and persistent inflationary headwinds expansion in FY2023, after a brief hiatus in FY2021

remain key risks to demand. and FY2022, with the store count of ICRA’s sample set

of jewellers estimated to have risen by more than 20%

ICRA’s sample set of 14 large jewellers, which accounts during the year. The momentum is likely to continue over

for ~70% of the organised market, is projected to record the near-to-medium term with a likely increase in the

a healthy revenue expansion of 15-18% YoY in FY2024 store count by 18-20% YoY in FY2024, supporting their

on the back of their planned retail expansion and a revenue growth.

Source: ICRA Research

31