Page 10 - Bullion World Volume 3 Issue 9 September 2023

P. 10

Bullion World | Volume 3 | Issue 9 | September 2023

IGC 2023: Highlights Part 1

PMLA Compliance and its Impact

on India's Bullion and Jewellery sector

Mr Surendra Mehta, National Secretary, IBJA, Mr Bhargava Vaidya, BN Vaidya & Associates,

Mr Rajarshi Kumar, Additional Director, Financial Intelligence Unit (FIU) India (Online)

Mr Rajarshi Kumar started the proceedings for this session by stating the meaning of Money

Laundering, which is-

• To convert black money (illegally earned) money into legitimate money

• Invested in such a way that even the investigating agencies can’t trace the main source of wealth

• The person who manipulates this money is called a ‘launderer.’

• As per a study by The United Nations Office on Drugs and Crime (UNODC), criminal proceeds

amounted to 3.6% of global GDP and 2.7% of Laundered Money.

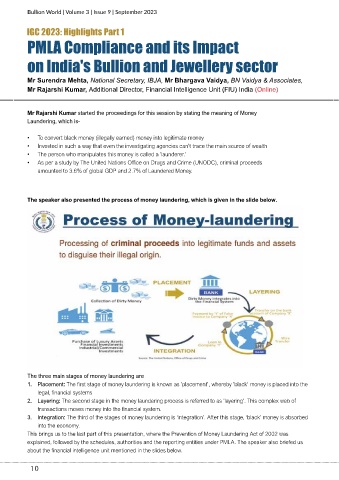

The speaker also presented the process of money laundering, which is given in the slide below.

The three main stages of money laundering are

1. Placement: The first stage of money laundering is known as ‘placement’, whereby ‘black’ money is placed into the

legal, financial systems

2. Layering: The second stage in the money laundering process is referred to as ‘layering’. This complex web of

transactions moves money into the financial system.

3. Integration: The third of the stages of money laundering is ‘integration’. After this stage, ‘black’ money is absorbed

into the economy.

This brings us to the last part of this presentation, where the Prevention of Money Laundering Act of 2002 was

explained, followed by the schedules, authorities and the reporting entities under PMLA. The speaker also briefed us

about the financial intelligence unit mentioned in the slides below.

10