Page 23 - Bullion World Volume 3 Issue 1 2023

P. 23

Bullion World | Volume 3 | Issue 1 | January 2023

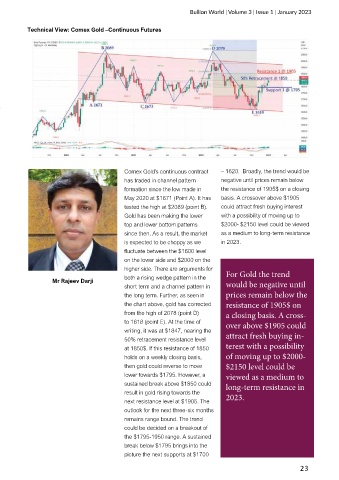

Technical View: Comex Gold –Continuous Futures

Comex Gold’s continuous contract – 1620. Broadly, the trend would be

has traded in channel pattern negative until prices remain below

formation since the low made in the resistance of 1905$ on a closing

May 2020 at $1671 (Point A). It has basis. A crossover above $1905

tested the high at $2089 (point B). could attract fresh buying interest

Gold has been making the lower with a possibility of moving up to

top and lower bottom patterns $2000- $2150 level could be viewed

since then. As a result, the market as a medium to long-term resistance

is expected to be choppy as we in 2023.

fluctuate between the $1600 level

on the lower side and $2000 on the

higher side. There are arguments for

both a rising wedge pattern in the For Gold the trend

Mr Rajeev Darji

short term and a channel pattern in would be negative until

the long term. Further, as seen in prices remain below the

the chart above, gold has corrected resistance of 1905$ on

from the high of 2078 (point D) a closing basis. A cross-

to 1618 (point E). At the time of over above $1905 could

writing, it was at $1847, nearing the

50% retracement resistance level attract fresh buying in-

at 1850$. If this resistance of 1850 terest with a possibility

holds on a weekly closing basis, of moving up to $2000-

then gold could reverse to move $2150 level could be

lower towards $1795. However, a viewed as a medium to

sustained break above $1850 could long-term resistance in

result in gold rising towards the

next resistance level at $1905. The 2023.

outlook for the next three-six months

remains range bound. The trend

could be decided on a breakout of

the $1795-1950 range. A sustained

break below $1795 brings into the

picture the next supports at $1700

23